Decarbonizing Food & Beverage

🌍 Carbon markets can feel overwhelming—fragmented data, limited transparency, and conflicting advice make it hard to know where to start. In this webinar, our experts give a clear, practical introduction to the VCM.

Exploring the challenges, strategies, and opportunities for reducing emissions in food and beverage.

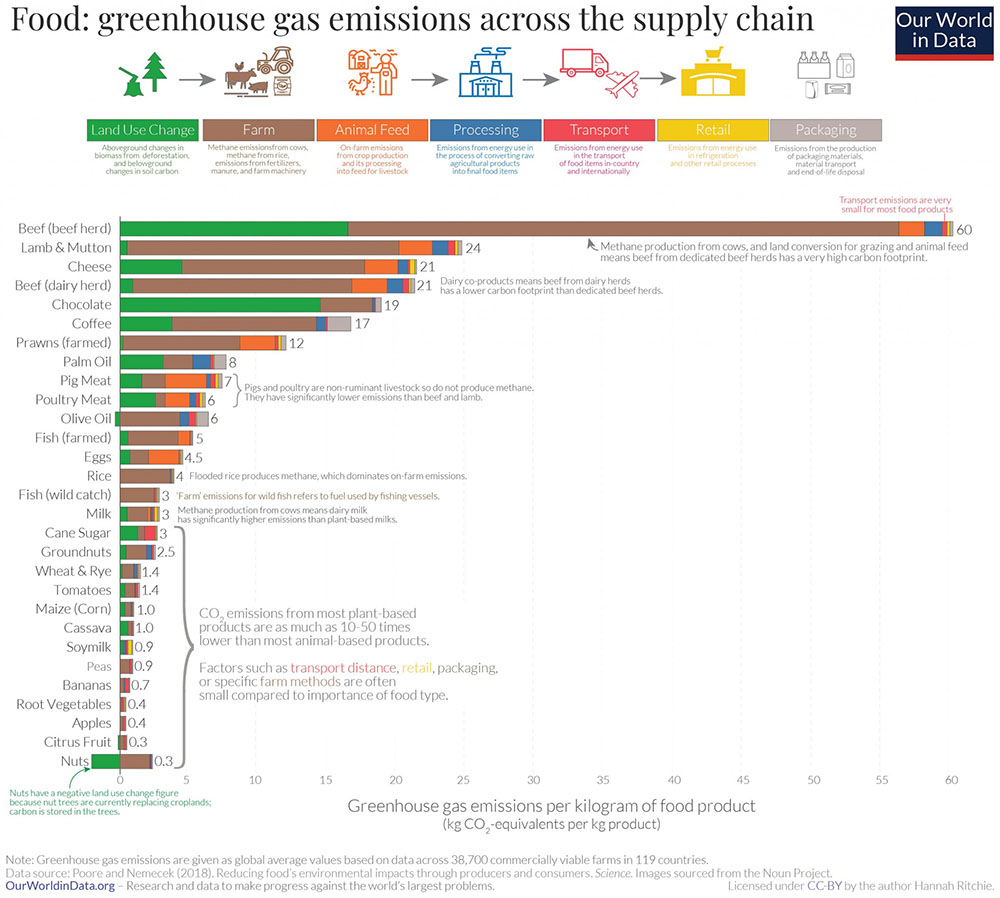

The food and beverage (F&B) industry significantly contributes to global greenhouse gas emissions (GHG), accounting for approximately 26% of total emissions. Agriculture is the elephant in the F&B room, responsible for 11% of the global GHG emissions. In addition to this, other emission sources to consider are processing, packaging, and transportation associated with F&B products. Companies operating in this space are beginning to accept the significant role they have to play in reducing these emissions. And while saving the planet should already be enough to commit to decarbonization, companies who have begun working on decarbonization acknowledge that a climate-friendly business strategy also makes financial sense. That’s not only because customers are starting to reward companies that drive environmental stewardship but also because the F&B sector faces significant climate risks—maybe even more than other sectors—and must take climate action to secure supply chains and preserve value. As a result, it’s imperative for companies to understand key threats to their business and prevent them from occurring.

Climate Risk

Physical Risk

Drought & Extreme Heat

Physical risks are perhaps the easiest climate impacts to envision. It’s hard not to think about the recent wildfires in LA, for instance, that burned down houses, restaurants, and farmlands. Along with stronger winds and higher temperatures, an unusually long dry spell was one of the key factors fueling blazes.

Yet, climate-driven water scarcity doesn’t need to spark wildfires to severely damage crop yield. As reported by the Federal Emergency Management Agency (FEMA), drought is the number one economic threat for agriculture. Relying on water-sensitive crops such as fruits, nuts, and vegetables, California reports the highest per-farm yearly loss on average ($19,734).

Besides stressing plants, extreme weather events such as heat waves also affect animals. Summertime is becoming a nightmare for Texas ranchers. The scorching heat makes it difficult for cattle to cool off even at night. Needless to say, this could hurt dairy & meat production.

Storms & Flooding

If drought gives farmers headaches, too much water is not good news either. In 2011, Tropical Storm Irene damaged 15,400 acres of farmland in western Massachusetts and Vermont. Hurricanes Irma and Ian significantly contributed to reducing Florida’s orange harvests by over 40% between 2020 and 2024.

Like wildfires, storms can cause power outages that hinder factory operations. As you can imagine, electricity disruptions can lead to significant financial losses.

| Risk Type | Example | Impact |

| Drought | California crop loss due to water scarcity | Reduced yields, higher costs |

| Extreme Heat | Heat stress in Texas cattle | Lower dairy/meat production |

| Flooding | Tropical Storm Irene in MA/VT | Crop destruction, soil erosion |

| Storms & Power Loss | Hurricanes Irma and Ian affecting orange harvests | Supply disruptions, production downtime |

Transition Risk

Physical risks are relatively straightforward to identify, whereas transition risks are more complex and less tangible. Here are some examples from the F&B industry.

Regulatory Risk

Although not as fast as the climate, environmental regulations will rapidly change over the next few years. Firms should adapt their business model accordingly to keep up with them and avoid fines. For instance, all companies with revenues greater than $1B and operating in California will have to disclose their Scope 1,2 & eventually Scope 3 emissions starting in 2026 according to the laws passed by California. Lawmakers in states like New York and Colorado are also discussing similar legislation. Additionally, Europe has proposed its Corporate Sustainability Reporting Directive (CSRD), which, albeit potentially delayed by two years, will require large companies operating in Europe to begin reporting their environmental, social, and governance (ESG) program.

Starting in December 2025, placing cocoa, coffee, soya, or palm oil on the European Union (EU) market will involve complying with the EU Deforestation Regulation (EUDR). To meet the legislation requirements, companies will have to prove that their sourcing is deforestation-free. Meeting these obligations implies liaising with farmers, verifying their practices, and gathering lots of data.

Market Risk

Another critical risk to consider is the evolving customer expectation and behavior shift amidst climate change and associated challenges. Customers are willing to pay for and prefer sustainable products— as long as taste and nutrition are comparable to leading non-sustainable options. A recent survey from YouGov found that over 50% of shoppers are willing to pay a 10% extra for more sustainable food and drink. Fed by the vegan movement, the demand for plant-based food is growing. Based on MarketsandMarkets, the alternative proteins market is predicted to hit $25.2 billion by 2029, up from USD$15.7bn in 2024. There’s a newly coined word that best exemplifies this type of transition risk: Sogflation. This term describes the rise of food prices driven by heavy rain and floods. The same trend is also associated with drought, causing shortages of corn and soybeans in the Midwest.

“Reducing the F&B industry’s climate impact isn’t just possible—it’s essential for both the planet and the long-term resilience of F&B businesses.”

Pankaj Tanwar, Managing Director, Climate Services

Reputation Risk

In addition to choosing greener diets, consumers are also more aware of sustainability and climate action by brands—and they're factoring it into their purchasing decisions. Therefore, investing in plastic-free packaging or planet-friendly products today means gaining a competitive advantage tomorrow. Apart from consumers, investors are becoming more demanding when vetting firms for ESG performance. One way for companies to make their climate claims greenwashing-proof is to align their food & drink labeling with the US Green Guides. Companies can also explore creating "climate-neutral" product lines to appeal to climate-conscious consumers.

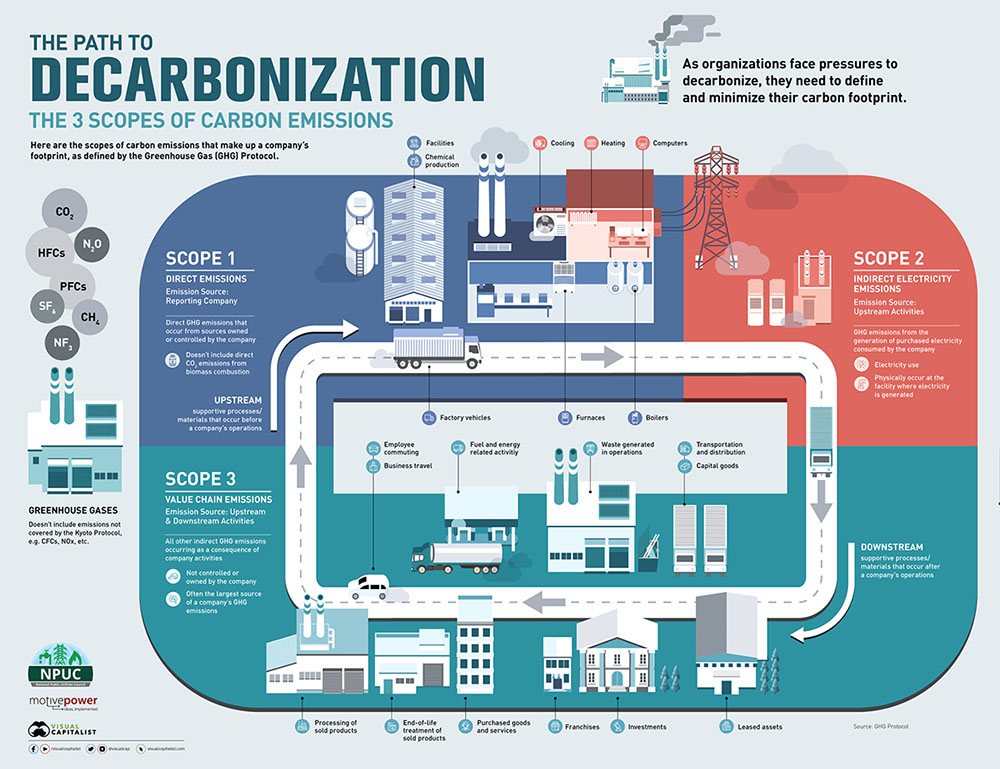

Measuring Emissions

Given the above-mentioned risks, the F&B industry needs to start taking definitive steps toward reducing their carbon emissions. The first step is to deeply understand their emissions footprint across their direct (Scope 1 and 2) and indirect emissions (Scope 3).

- Scope 1: Direct emissions from food production facilities and operations.

- Scope 2: Indirect emissions from purchased electricity, heat, and cooling.

- Scope 3: Emissions from supply chain activities, such as agricultural inputs, transportation, and packaging.

The complexity of F&B’s supply chain makes the assessment of Scope 3 emissions even more challenging compared to other sectors. Most companies begin by taking a spend-based approach to estimating emissions before gradually moving towards activity-based measurement. Some more advanced companies also conduct a life cycle assessment (LCA) for their largest product lines to get the most accurate picture of what parts of their value chain drive the majority of emissions, which requires working with suppliers and encouraging them to be transparent about their environmental impact. While this sounds like an impossible mission, there are ways to make it manageable to collect, evaluate, and analyze data across their value chain.

Reducing Emissions

Once companies have a more precise estimate of their carbon emissions, they should strive to reduce them. Depending on where they are along their decarbonization journey, here are a few actions that F&B firms can take to go on a “low-carbon diet.”

| Strategy | Action |

| Sustainable Agriculture | Regenerative practices, plant-based products |

| Energy Efficiency & Renewables | Smart tech, circular thermal systems, renewable energy sourcing |

| Packaging Innovation | Plastic-free materials, recyclability improvements |

| Supply Chain Optimization | Local sourcing, traceability platforms |

| Waste Reduction & Circularity | Food-to-fuel conversion, composting |

| Beyond Value Chain Mitigation | Carbon credits, agroforestry, grassland restoration |

- Sustainable Agricultural Practices: Requiring an enormous amount of land, livestock grazing, and feeding (i.e., monoculture plantations) is driving deforestation. Accordingly, investing in meat-free alternatives should be a priority for food producers who want to decarbonize their value chain while grabbing new market opportunities. Another item that should be on top of the F&B agenda is promoting regenerative agriculture methods such as composting and agroforestry.

- Energy Efficiency in Processing and Manufacturing: While switching to renewable energy should be a no-brainer, chances are that F&B firms will not be able to power their whole operations without using any fossil fuels. For this reason, it’s important to harness energy-efficient technologies (e.g., circular thermal) and smart tools to monitor energy consumption and spot inefficiencies.

- Sustainable Packaging Solutions: Plastic has permeated the F&D value chain so much that people are actually eating and drinking it, which is why companies should tap into plastic-free packaging alternatives (e.g., bioplastics). If designers can't avoid using plastic, they should focus on maximizing the recyclability of the packaging.

- Supply Chain Optimization: Local smallholders should be preferred and empowered whenever possible. If this is not feasible, turning to a traceability platform might be an efficient solution to have an oversight on farmers. This digital tool allows F&B players to trace their crops all the way back to the farm where they were grown and check whether they are deforestation-free. Finally, signing up for a supply chain reduction program would be a wise choice.

- Waste Reduction and Management: In line with circular economy principles, the F&B sector should explore ways to convert food waste into a resource such as biogas, biomethane, and sustainable aviation fuels (SAF).

- Driving Beyond Value Chain Mitigation: After making internal emissions reductions, companies can further their impact by purchasing carbon offsets or directly investing in projects like grassland restoration or agroforestry to reduce emissions beyond their direct value chain. SBTi's new draft states that companies can buy indirect mitigations for their supply chain decarbonization (e.g., a company with livestock in the supply chain can buy from our livestock grazing projects). SBTi has also specified additional credits for companies investing in BVCM (Beyond Value Chain Mitigation)

Industry Highlights

Here are some examples of F&B companies that are leading the climate-conscious way.

To meet its ambitious carbon reduction targets (40% by 2030), PepsiCo has launched a Sustainability Action Center to engage suppliers in greener initiatives. On top of that, as part of its pep+ REnew program, the beverage giant has issued $2.25 billion in green bonds since 2019 to let its value chain partners access renewable electricity.

PepsiCo also doubled its regenerative farming acreage. Yet, PepsiCo is in good company. As part of a program called “Generation Regeneration”, Nestlé is investing $1.3 billion to enable farmers to adopt regenerative practices.

Morrisons had a fair crack at reducing the environmental impact of their eggs. The UK supermarket chain laid carbon-neutral eggs by spiking chicken feed with insects. Sainsbury, Morrison’s competitor, applied the same principle with a different recipe. Instead of insects, in this case, farmers fed chickens beans.

Mars, Inc. has set a target to reach net-zero emissions by 2050. The company works with dairy farmers to reduce methane emissions through feed additives and improved manure management. Mars anticipates addressing 20% of its emissions by purchasing high-quality carbon credits, integrating carbon offsets into its comprehensive sustainability strategy.

Conclusion

Reducing the F&B industry’s climate impact isn’t just possible—it’s essential for both the planet and the long-term resilience of F&B businesses. However, it will require ongoing collaboration between all stakeholders, from farmers to consumers. If your company needs help at any step of your sustainability journey—we’re here to help. Contact us today to get started.

Start with a baseline emissions assessment, focusing first on Scope 1 and Scope 2 emissions, then expanding to Scope 3 using spend-based estimates. From there, you can work toward more accurate activity-based or lifecycle assessments (LCAs). CarbonBetter can help you navigate this process and identify the right tools and data sources to build a complete emissions profile.

Scope 3 emissions are challenging but not impossible to address. You can start by engaging key suppliers, using traceability platforms, and participating in programs that encourage supplier data sharing and transparency. CarbonBetter offers supply chain engagement strategies and tools to help companies increase visibility and set meaningful targets.

Some of the most impactful decarbonization strategies for food and beverage companies include shifting to regenerative agriculture practices, which help restore soil health and reduce emissions at the source. Optimizing packaging by reducing plastic use or improving recyclability is another high-impact area, along with transitioning to renewable energy and improving energy efficiency in processing and manufacturing. Reducing food waste—and converting it into energy sources like biogas or sustainable aviation fuel—can further cut emissions while creating additional value. Finally, investing in beyond value chain mitigation (BVCM), such as high-quality carbon offsets or nature-based solutions like agroforestry, can help companies reduce emissions they can’t directly control. At CarbonBetter, we help F&B clients identify and prioritize the strategies that best align with their operations, emissions profile, and sustainability goals.

Transparency and traceability are key. Use data-backed claims, align with frameworks like the U.S. Green Guides, and ensure third-party verification where possible. Creating climate-neutral product lines can also build credibility. CarbonBetter supports companies with sustainability communications and reporting strategies that build trust and comply with evolving regulations.

Yes, high-quality carbon offsets can play a role, especially after internal reductions have been made. Look for credits that are verified, additional, and aligned with your supply chain risks (e.g., livestock methane offsets if you source meat or dairy). CarbonBetter helps companies vet offset projects and integrate them into a broader decarbonization plan.

About the Author

Pankaj Tanwar is Managing Director of Climate Services at CarbonBetter. He has experience leading Fortune 100 companies through their sustainability journeys, including sustainability driven growth in the food industry. Pankaj holds an MBA from Northwestern University’s Kellogg School of Management and a BTech in Mechanical Engineering from the Indian Institute of Technology, Kanpur.