RNG in Your Decarbonization Strategy

RNG Sourcing

The CarbonBetter team sources renewable natural gas for clients across industry sectors—reach out today to learn more.

Contact Us

Certified Offset Portfolios

Buying high-quality carbon offsets has never been easier. Explore CBCO Portfolio 22-1 and get instant access to fully vetted carbon offsets.

RNG is a key tool in a portfolio approach to decarbonization, but when is the right time to use it?

Renewable Natural Gas (RNG) is a term used to describe biogas, which is gas produced from the decomposition of organic materials under anaerobic conditions. As discussed in a previous blog post, RNG is made from organic material that has broken down and released methane and carbon dioxide. Sources of RNG originate from solid waste landfills, wastewater treatment facilities, and livestock farms to name a few examples. RNG can be substituted for fossil fuels for use in thermal applications, to generate electricity, for vehicle fuel, and as bio-product feedback.

RNG is a compelling alternative fuel because it serves as a decarbonization solution for both the producer and the consumer. Without the development of RNG processing facilities, these landfills, farms, and water treatment facilities would release greenhouse gases (GHGs) into the atmosphere. Likewise, the energy consumer would rely on natural gas derived from fossil fuels to fulfill their demand. Since RNG is interchangeable with traditional natural gas, it can be distributed using existing natural gas distribution systems. The advantages are many, so let’s explore what it takes to make it a part of your decarbonization strategy.

RNG Market Dynamics

RNG production has increased in recent years, growing threefold in the past five years. Demand is underpinned by two sectors: the compliance market and the voluntary market. The compliance market refers to organizations that are required by regulation to purchase low-carbon fuels according to programs such as the US Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS). The voluntary market refers to entities that are buying RNG of their own volition to address their carbon footprint.

The compliance market demand outweighs that of the voluntary market, thus requiring voluntary participants to accept the compliance pricing levels. Pricing can range anywhere from $15 to $30 per dekatherm depending on volume, geography, vintage, and carbon-intensity score, making it a considerable premium to traditional natural gas.

This premium over conventional natural gas is driven by supply limitations. While many new RNG facilities are in planning phases for construction, there is increasing speculation that new project development could plateau as the most optimal sites have already been developed.

READ ALSO: A Primer on Renewable Natural Gas (RNG)

Using RNG

Since the market dynamics favor the supply side, producers often aim to strike favorable long-term offtake agreements for their production. This allows producers to mitigate risk from market volatility by hedging their economics through commercial arrangements. Additionally, to receive the gas, the buyers’ facilities must be connected to the same distribution network that the RNG is injected into. This requires buyers to have the ability to manage transport logistics, whether using internal resources or a third-party energy logistics firm.

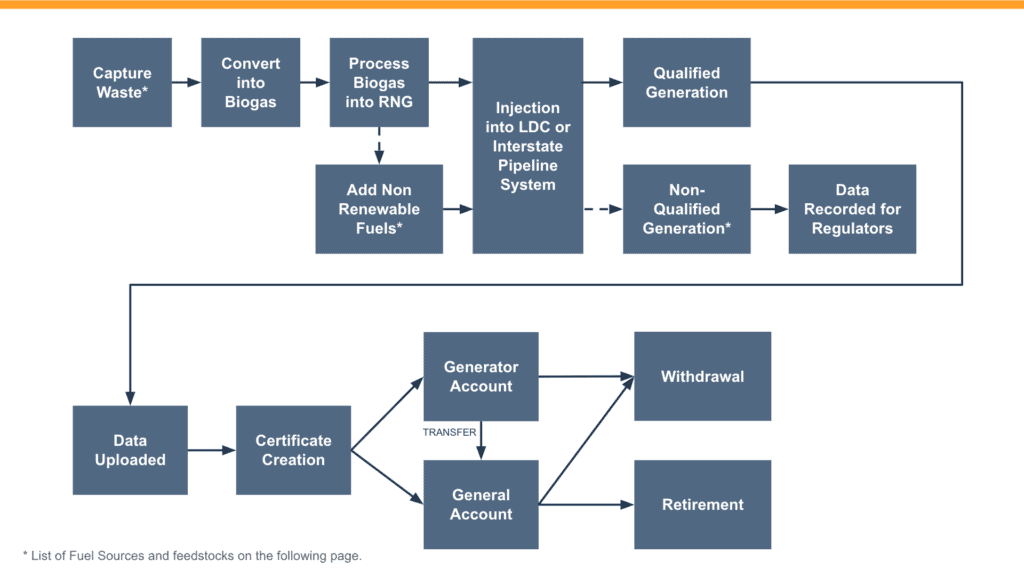

Although these constraints may be too much to overcome for many interested companies, there is a simpler way to procure and utilize RNG as a decarbonization tool. RNG projects are certified by environmental tracking registries, such as M-RETS. When a registry certifies an RNG facility, it issues a certificate for every dekatherm of RNG produced. This allows the producer to sell the certificate separate from the physical natural gas, making the RNG claim more widely accessible while preventing double-counting of the environmental benefit. When attributes are purchased, they are transferred to the offsetting entity or to a designated environmental commodity marketer acting on the buyer’s behalf. In order to fulfill the claim of using RNG to offset traditional natural gas consumption, the certificate must be retired on the registry to permanently take it out of circulation. These attributes are often called “RINs,” or Renewable Identification Numbers, as termed by the compliance programs. On M-RETS the attribute is called a Renewable Thermal Certificate (RTC).

Renewable Thermal Certificate Creation Process – M-RETS. Image courtesy of mrets.org.

Deciding to Use RNG in Your Decarbonization Strategy

RNG is an important tool for natural gas decarbonization during the energy transition because it allows us to make use of existing thermal infrastructure. Many organizations are increasingly considering the electrification of their facilities, but this can require significant capital expenditure and effort to implement. This makes RNG an easier alternative in the interim.

The one drawback to RNG is the cost. As mentioned earlier, RNG can cost three to five times more than traditional natural gas. Nonetheless, ESG-focused companies value this as part of their decarbonization plan because it makes a direct impact while channeling funds into the RNG sector, which is needed to support further supply development in the market. RNG can be coupled with carbon offset credits to further the scope of a company’s decarbonization efforts while keeping costs manageable.

CarbonBetter advises clients on taking a portfolio approach to decarbonization, enabling companies to take advantage of a diverse set of solutions and spreading their financial impact across carbon technologies that they wish to support. With a carbon offset credit equalling one metric ton of CO2, a credit can be used to offset emissions of around 18.21 dekatherms of natural gas according to the EPA’s conversion factors. If a company were to buy a carbon offset at $10, this would equate to a cost per dekatherm of $0.55. Compared to RNG costs ranging from $15 – $30 per dekatherm, this is considerably more cost-effective. Therefore, a company seeking to neutralize emissions from natural gas consumption can adjust the ratios between RNG and carbon offsets to meet its budget. The company may also plan to step up its carbon neutralization goals over a period of time, starting with a percentage in year one, and working its way towards 100% by its target carbon-neutral year. This approach allows emitters to right-size their solution based on their own roadmap.

CarbonBetter’s team of carbon marketers and climate consultants are positioned to guide ESG-oriented companies in considering their options and implementing decarbonization solutions. Reach out to the team if you’re interested in exploring your path to a net-zero future.