What’s Next for Climate Regulations in 2025

🌍 Carbon markets can feel overwhelming—fragmented data, limited transparency, and conflicting advice make it hard to know where to start. In this webinar, our experts give a clear, practical introduction to the VCM.

The impact of climate legislation on US businesses.

As of January 22, 2025, US-based businesses are facing a rapidly shifting regulatory landscape when it comes to climate-related policies. With a new administration in place, significant changes to environmental regulations are either underway or expected. Timelines for some rules, like the Securities and Exchange Commission (SEC) climate disclosure requirements which are already facing legal scrutiny, may have got extended while others, such as state-level mandates from California and international reporting obligations like the European Union’s Corporate Sustainability Reporting Directive (CSRD), are set to take effect over the next few months. Thus, despite federal changes, given that state and international regulations are still moving forward, companies with global supply chains or with business in key states must stay ahead of compliance requirements.

Large companies and corporations operating in jurisdictions with strong climate laws—such as California and the European Union—will need to assess their exposure to new reporting mandates. Even if federal rules become more relaxed, businesses that interact with markets where disclosure is required will still need to comply with those standards. This makes understanding the evolving regulatory framework crucial for corporate risk management, investor relations, and long-term sustainability planning.

Below, we’ve outlined the key climate-related regulations and reporting requirements that U.S. businesses must be aware of, including effective dates, affected companies, and potential implications.

California Climate Disclosure Laws (SB 253 and SB 261)

- Enactment Date: October 7, 2023

- Effective Dates:

- SB 253 (Climate Corporate Data Accountability Act): Reporting begins in 2026 using 2025 data.

- SB 261 (Climate-Related Financial Risk Act): First reports due in 2026.

- Details:

- SB 253: Requires businesses with annual revenues over $1 billion operating in California to disclose Scope 1, 2, and 3 emissions. Law requires these environmental footprint estimations (Scope 1,2 and 3) to be assured by an independent third party.

- SB 261 (Climate-Related Financial Risk Act): Requires businesses with annual revenues over $500 million to assess and disclose climate-related financial risks following TCFD guidelines.

- Impacted Businesses: Any company meeting the revenue threshold and doing business in California (here is the criterion specified by State of California Franchise Tax Board), regardless of whether they are headquartered there.

- Implications: Companies must invest in emissions tracking, climate risk assessment, and regulatory compliance teams to meet California’s stringent standards.

FW Sustainability Report

Learn more about how Fierce Whiskers has made sustainable choices every step of the way by downloading its full sustainability report.

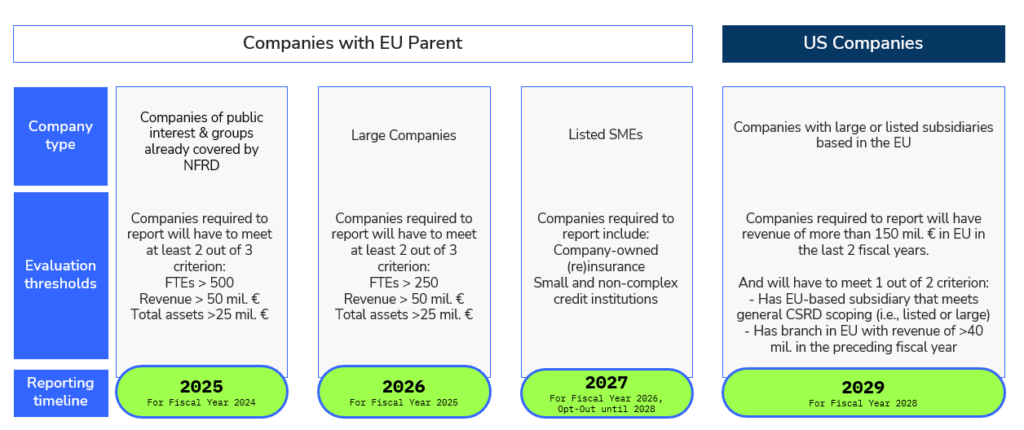

Corporate Sustainability Reporting Directive (CSRD) (EU Regulation Impacting U.S. Businesses)

- Adoption Date: November 10, 2022

- Effective Dates:

- 2025: For companies already subject to the Non-Financial Reporting Directive (NFRD), first reports are due.

- 2026: For large companies not currently subject to the NFRD, first reports are due.

- 2027: For listed small and medium-sized enterprises (SMEs), first reports are due.

- 2029: For US based companies with subsidiaries in the EU, first reports are due.

- Details: Requires detailed sustainability reporting, including environmental, social, and governance (ESG) factors.

- Impacted Businesses: U.S. companies with substantial operations in the EU will need to report per this standard. While official reporting is still some years out, European clients will begin expecting US companies to share CSRD mandated information when comparing against their EU counterparts.

- Implications: Affected companies will need to align sustainability reporting with EU standards, both for compliance purposes and to sustain their competitive advantage against EU counterparts. Getting ready for CSRD will require significant changes to data collection, cross-functional collaboration and disclosure practices.

EU Corporate Sustainability Due Diligence Directive (CSDDD) (Expected to Be Adopted in 2025)

- Expected Adoption Date: 2025

- Effective Date: Likely 2026 or 2027

- Details: The CSDDD will impose mandatory due diligence obligations on companies regarding human rights and environmental risks in their supply chains.

- Impacted Businesses: U.S. companies with significant operations in the EU or with supply chain partners that fall under EU jurisdiction.

- Implications: Companies will need to conduct due diligence on environmental and social risks within their global supply chains and implement corrective measures.

Federal Supplier Climate Risks and Resilience Rule

- Proposed Date: 2022 (Proposed but unlikely to take effect).

- Potential Implementation Date: Uncertain due to policy shifts under the current administration

- Details: Would require major federal contractors to disclose greenhouse gas emissions and climate-related financial risks.

- Impacted Businesses: Large suppliers contracting with the U.S. federal government.

- Implications: If implemented, affected businesses will need to integrate emissions tracking and climate risk disclosure into their federal compliance processes.

Securities and Exchange Commission (SEC) Climate Disclosure Rule

- Adoption Date: March 6, 2024 (Currently stayed during litigation).

- Initial Compliance Date: Previously set for fiscal years ending on or after December 31, 2025 (for large accelerated filers), the initial compliance date is now uncertain, and the rule may be repealed.

- Details: The SEC adopted rules requiring publicly traded companies to disclose material climate-related risks, including greenhouse gas (GHG) emissions and financial risks associated with climate change. However, the rule is currently stayed due to litigation and is unlikely to pass in the next four years.

- Impacted Businesses: Publicly traded companies, particularly large accelerated filers, must comply with these disclosure requirements.

- Implications: Companies will need to enhance tracking and reporting of climate-related risks, invest in sustainability reporting infrastructure, and prepare for potential investor and stakeholder scrutiny.

Preparing for the Future

As the regulatory landscape continues to evolve, businesses should take proactive steps to stay ahead of applicable rules and regulations and ensure compliance. Here are steps your business can take and how CarbonBetter can help.

| Step | Aim | How CarbonBetter Can Help |

| Identify relevant policies and frameworks | Review various frameworks and policies to determine which align with your business. | Conduct a thorough evaluation of applicable frameworks, perform a peer review, and identify strategic fits for compliance. |

| For relevant frameworks, identify and evaluate potential risks and opportunities | Understand risks and opportunities tied to emerging regulations and build a strong reporting strategy. | Run an applicability assessment, guide reporting processes, conduct climate scenario risk analysis, and assess materiality. |

| Set goals and prioritize changes | Establish clear sustainability goals aligned with regulatory demands. | Help set SMART goals and support implementation strategies. |

| Ensure infrastructure and expertise meet new reporting demands. | Ensure infrastructure and expertise meet new reporting demands. | Improve sustainability data, provide fractional team support, and craft sustainability narratives. |

Contact us today for help with any of these steps.

How CarbonBetter Can Help

Navigating the complex world of evolving and emerging sustainability regulations requires expert guidance. At CarbonBetter, we offer applicability assessments and gap analyses to first determine which frameworks your business must comply with. Our experts can then help you tell your sustainability story, with reporting, and by ensuring compliance with the latest standards.

Conclusion

We are at a critical juncture point in regulation. In a world in which climate regulations are picking up pace and businesses are realizing the urgent need to build resilience, it’s more important than ever to be proactive. By partnering with CarbonBetter, you can confidently navigate the fast-changing regulatory landscape, mitigate non-compliance risks, and identify growth opportunities.

No matter where you are in your climate journey, we are here to help. Reach out today to get started.

Sustainability regulations, especially in the current global context, are evolving rapidly. The frequency of changes can vary based on global events, political shifts, and emerging environmental data. Subscribe to our newsletter to stay up-to-date with the latest changes and upcoming regulations relevant to your operations.

Prioritizing regulations often depends on their applicability to your business, the region(s) you operate in, and the potential impact on your operations. CarbonBetter provides a regulatory impact assessment, helping businesses identify and prioritize regulations that are most pertinent to them, ensuring timely compliance and strategic planning. Contact us today to learn more.

While not all proposed regulations become law, they often indicate the direction in which the regulatory landscape is moving. It’s wise to consider the intent behind these proposals when shaping your sustainability strategy. CarbonBetter offers strategic consultation to help businesses adapt their sustainability plans, ensuring they remain forward-looking and resilient, regardless of regulatory uncertainties. Contact us today to learn more.

Continuous training and access to updated resources are crucial. CarbonBetter offers tailored training sessions and workshops for businesses, ensuring that internal teams are always equipped with the latest knowledge and skills to navigate the dynamic regulatory environment. Contact us today to learn more.

The key is to develop a flexible sustainability strategy that can accommodate regulatory changes without requiring complete overhauls. By setting broad, overarching goals and using adaptable tactics to achieve them, businesses can integrate new regulations seamlessly. CarbonBetter assists in crafting such dynamic strategies, ensuring businesses remain compliant while staying true to their long-term sustainability vision. Contact us today to learn more.

About the Author

Pankaj Tanwar is Managing Director of Climate Services at CarbonBetter. He has experience leading Fortune 100 companies through their sustainability journeys, including sustainability driven growth in the food industry. Pankaj holds an MBA from Northwestern University’s Kellogg School of Management and a BTech in Mechanical Engineering from the Indian Institute of Technology, Kanpur.