Addressing Hidden Emissions: Key Takeaways From Our SXSW 2024 Panel

As climate-related disclosure and mitigation requirements continue to evolve, understanding the latest regulatory landscape is essential for US companies. In this webinar, we cut through the jargon to provide clear insights into emerging climate-related requirements, breaking down two key federal proposals and one EU regulation impacting some US-based companies. Join us to stay informed and prepared for what’s ahead in climate compliance.

Our SXSW 2024 panel featured experts from Whole Foods Market, Asana, and Fierce Whiskers, focusing on strategies for reducing hidden emissions through collaboration and comprehensive approaches.

In the complex web of global commerce, the silent contributors to a company’s environmental footprint—hidden emissions—often go unnoticed. These indirect activities—procurement, transportation, waste disposal—while critical to operations, contribute to a company’s environmental footprint, particularly in the form of Scope 3 (value chain) emissions. Our SXSW 2024 panel brought together sustainability experts from Whole Foods Market, Asana, and Fierce Whiskers, to shed light on this pressing issue. The discussion offered an in-depth exploration into how each company addresses the concealment of emissions, the challenges of measurement, the need for collaborative efforts to ensure accuracy, strategies for decarbonization, and the inevitable trade-offs involved in making sustainable choices. Below are highlights from the discussion, along with practical takeaways that you can apply to your own organization’s sustainability journey. You can read the summary below and access the audio recording here.

Meet Our Moderator and Panelists

Pankaj, Managing Director of Climate Services at CarbonBetter: Pankaj leads CarbonBetter’s climate team. He has extensive experience in the sustainability, energy and food distribution sectors, having previously led sustainability-driven revenue growth at Sysco and sustainability strategy across multiple sectors at McKinsey & Company.

Tri, Co-Founder of Fierce Whiskers: Fierce Whiskers takes an innovative approach to whiskey production, focusing on the distillery’s sustainability-first ethos, efficiency in facility design, and the launch of a carbon-negative whiskey.

Caitlin, VP of Sustainability at Whole Foods Market: Caitlin leads Whole Foods Market’s sustainability vision and strategy. From climate & nature, to waste & packaging, she is responsible for creating and implementing the company’s sustainability vision and strategy across over 550 stores worldwide.

Sean, ESG Strategy Leader at Asana: Sean leads ESG strategy and reporting at Asana, spearheading the company’s first GHG inventory, implementing 100% renewable electricity and carbon neutrality programs, and publishing the company’s first supplier code of conduct.

What are Scope 1, 2, and 3 Emissions?

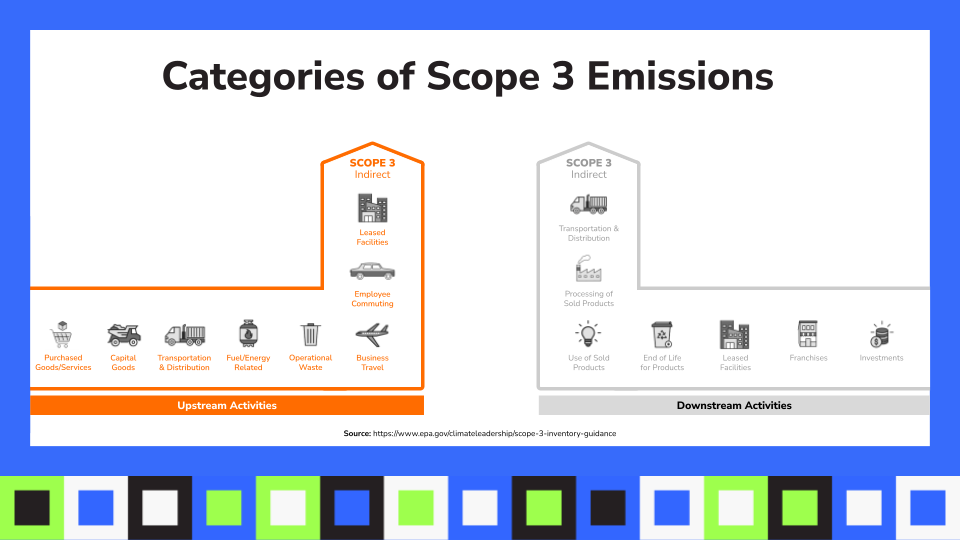

Before exploring how each company tackles the challenges surrounding their hidden emissions, the stage was set by defining Scope 1, 2, and 3 emissions, with an emphasis on the various categories of Scope 3 emissions.

Scope 1 emissions are direct, from owned or controlled sources like vehicles and boilers—these are highly visible and manageable. Scope 2 covers indirect emissions from purchased energy, such as electricity used in company operations, which can be reduced by opting for renewable sources and improving efficiency. The most complex, Scope 3 emissions, include all other indirect emissions from a company’s value chain, like purchased materials, business travel, and product life cycles, often making up the largest part of a company’s footprint. Addressing Scope 3 is crucial for significant environmental impact, demanding a comprehensive approach to the supply chain, supplier collaboration, and innovative emission reduction strategies.

Categories of Scope 3 Emissions

Scope 3 emissions are categorized into 15 diverse segments, reflecting the broad spectrum of indirect contributions to greenhouse gas emissions through organizational value chains. Understanding these categories is crucial for companies aiming to reduce their environmental impact comprehensively. In the image below, these categories are broadly divided into two groups: upstream ( 8 categories) and downstream emissions (7 categories). Focus of the discussion was more on the upstream categories.

Why is Estimating Supply Chain Scope 3 Emissions Important?

Pankaj introduced a startling statistic from a WRI report, noting that only 54% of organizations in sectors with significant Scope 3 emissions disclose comprehensive information on these emissions. This figure is even lower in the United States. In addition, on average, about 75% of emissions for most companies fall under Scope.

Tri emphasized the strategic importance of estimating Scope 3 emissions to focus efforts on areas with the most significant impact. Caitlin revealed that for Whole Foods Market, about 70% of emissions are tied to the products they sell on their shelves, making Scope 3 emissions a critical focus area. Sean echoed the sentiment, noting that the vast majority of Asana’s emissions are Scope 3, emphasizing the need for comprehensive measurement and management.

What Makes Scope 3 Emissions So Complex?

Caitlin highlighted the measurement challenges of hidden Scope 3 emissions, noting the difficulty of gathering accurate data across various suppliers, each potentially following different reporting standards and methodologies. This variability introduces significant obstacles in obtaining a clear picture of a company’s total environmental impact. The need to rely on estimations or broad averages further complicates the task, as these methods may not accurately reflect the specific emissions related to certain products or practices, such as those associated with climate-smart agriculture or regenerative farming techniques.

What are some sources of “hidden emissions”?

“Hidden emissions” within Scope 3 include those arising from various stages of the product lifecycle that are not directly produced by the company’s operations but are nonetheless part of its value chain. These can include emissions associated with the transportation and logistics of moving materials and products, which are complex to track and manage. Manufacturing processes also pose a significant challenge, as emissions from the production of components or materials used in the company’s products can be substantial but difficult to quantify accurately.

Caitlin and Sean highlighted the need for a holistic sustainability approach that addresses these hidden emissions comprehensively. This includes considering the environmental impacts of product use and disposal, capital goods, employee commuting, business travel, and procurement practices, among others.

Sources of hidden emissions include:

- Transportation and Logistics

- Manufacturing Processes

- Product Use and End-of-Life

- Capital Goods

- Employee Commuting and Business Travel

- Procurement Practices

- Waste Generated in Operations

“Scope 3 emissions are often much greater than Scope 1 and Scope 2. But unfortunately, it is also the Scope 3 emissions which are typically overlooked and stay hidden. In fact, there’s a WRI report which said that only about 54% TCFD preparers actually disclose Scope 3, and this number is even lower here in the United States (US).”

PANKAJ TANWAR, MANAGING Director OF CLIMATE SERVICES

Skip the RFP—CarbonBetter can help

CarbonBetter Certified Offset Portfolios allow carbon buyers to participate in a variety of projects, geographies, and technologies in one simple transaction rather than navigating a lengthy and complex RFP process with multiple carbon market participants.

Learn More about CBCO 22-1What strategies are your companies utilizing to reduce Scope 3 emissions?

Product Lifecycle Analysis (Caitlin, Whole Foods Market): Conducting a product lifecycle analysis allows companies to assess the environmental impacts of their products from production to disposal. By encouraging suppliers to adopt sustainable practices and selecting products that align with organic or regenerative agricultural practices, Whole Foods Market is addressing emissions throughout the product lifecycle. Investing in carbon insetting projects within their supply chain further demonstrates their commitment to mitigating Scope 3 emissions by enhancing the carbon sequestration potential of their supply chain.

Local Sourcing and "Grain-to-Glass" Production (Tri, Fierce Whiskers): Emphasizing local sourcing reduces the need for long-distance transportation, directly impacting the reduction of transportation-related emissions. Integrating sustainability into facility design can significantly enhance resource efficiency, lowering the overall environmental impact of production processes. This approach not only benefits the environment but also supports local economies.

Advanced Data Collection and Analysis (Sean, Asana): The emphasis on advanced data collection and analysis for identifying emissions highlights the importance of understanding the scope and sources of Scope 3 emissions. By engaging suppliers through clear communication and collaboration, Asana is working towards meeting its sustainability goals and supporting suppliers in making necessary improvements. Prioritizing transparent sustainability reporting and innovation in product design and processes helps minimize emissions and demonstrates a commitment to sustainability.

What are your companies doing to overcome the hurdle of data quality and availability?

Caitlin (Whole Foods Market) emphasized the importance of data-sharing and transparency initiatives. She highlighted Whole Foods' efforts to spearhead industry-wide collaborations to standardize emissions reporting, improving the accuracy and reliability of Scope 3 data.

Tri (Fierce Whiskers) focused on the significance of engaging suppliers directly to enhance their data collection and reporting capabilities. He shared Fierce Whiskers' approach to offering training, resources, and sometimes financial support to suppliers, ensuring they adopt better data management practices, which in turn strengthens the sustainability efforts across the supply chain.

Sean (Asana) discussed the crucial role of technology and software in overcoming data challenges. Sean detailed how Asana uses advanced software solutions to aggregate and analyze emissions data across their supply chain, providing actionable insights to mitigate Scope 3 emissions effectively.

Pankaj (CarbonBetter) spoke about leveraging industry associations and collaborative sustainability initiatives as a strategy to tackle data challenges and supplier engagement. Pankaj mentioned CarbonBetter's involvement in supporting industry-wide standards for emissions reporting, advocating for transparent and consistent data disclosure across all players in the industry.

How do you engage suppliers to estimate and reduce emissions? What strategies do you use to incentivize supplier collaboration?

Caitlin (Whole Foods Market) highlighted the importance of transparent communication and setting clear expectations with suppliers. Whole Foods works closely with suppliers, providing tools, training, and guidance to improve their sustainability practices. They emphasize the use of environmental certifications and standards to encourage suppliers to adopt better practices.

Tri (Fierce Whiskers) talked about building long-term partnerships and integrating sustainability into the core of business relationships. By offering longer contracts and prioritizing suppliers for future opportunities, Fierce Whiskers motivates suppliers to invest in emissions reduction efforts. Tri also discussed financial incentives and shared benefits, such as price premiums for lower-emission goods, to encourage supplier engagement.

Sean (Asana) mentioned the role of collaborative projects and joint ventures in aligning interests and pooling resources for greater impact. Asana explores initiatives that bring together multiple stakeholders in the supply chain to address emissions reduction challenges. Sean also emphasized the importance of recognizing and rewarding suppliers' sustainability achievements to set a positive example.

What are the potential trade-offs involved in making sustainable choices when thinking about supply chain emissions?

Caitlin (Whole Foods) highlighted environmental trade-offs, such as the challenge of choosing materials that minimize carbon emissions without adversely affecting water usage or contributing to deforestation. She emphasized the importance of considering the wider range of environmental impacts beyond carbon.

Tri (Fierce Whiskers) addressed the need to source the best grains possible first and foremost. He talked about the tradeoff between shareholder economics and reducing environmental footprint. With much of the country in drought, supplier options can already be limited, even before trying to incorporate sustainability.

Sean (Asana) spoke on operational and financial trade-offs. He discussed the need to balance the upfront investments and potential operational changes required for adopting renewable energy sources and carbon offset programs against their long-term benefits and costs, stressing the importance of evaluating these initiatives for their overall impact on operational efficiency and cost-effectiveness.

How do you envision the impact of the ever evolving landscape of regulations and protocols on supply chain sustainability?

Below is a summary of how each panelist envisions the impact of the ever evolving landscape of regulations and protocols on supply chain sustainability:

Caitlin (Whole Foods Market) discussed the role of regulations, such as those from the Securities and Exchange Commission (SEC) climate rules and the European Union (EU)'s Corporate Sustainability Reporting Directive (CSRD), in elevating industry standards and encouraging companies that might otherwise overlook their emissions to take action. While companies like Whole Foods Market are at the forefront, leading and elevating standards, she views regulations as instrumental in raising the baseline as well.

Tri (Fierce Whiskers) observed that it's an exciting time, noting that the task of addressing sustainability and climate change revolves around problem-solving. Regulations, in his view, help outline the problem and ensure everyone is progressing in the right direction.

Sean (Asana) spoke on the importance of industry-wide collaboration to address sustainability challenges, particularly those related to Scope 3 emissions. He mentioned the potential for partnerships and initiatives across industries to develop shared solutions and best practices, aiding companies in meeting regulatory requirements more effectively.

“Don’t be afraid to make a mistake, and also create room for others to make mistakes … We have to be willing to make mistakes to move forward.”

TRI VO, CO-FOUNDER OF FIERCE WHISKERS

What advice would you give to other companies working to address their supply chain emissions?

The consensus among the panelists was clear: start small, set achievable goals, and prioritize engagement and transparency. Emphasizing the importance of making a start, regardless of how small, and building from there was a key takeaway. Some other highlights include:

- Gain a comprehensive understanding of your supply chain emissions.

- Set clear, achievable goals aligned with global sustainability standards.

- Engage suppliers early, offering support and incentives for sustainability efforts.

- Stay informed and adaptable to regulatory changes and industry best practices.

Conclusion

We were honored to be at SXSW for the 3rd year in a row to discuss these important topics surrounding sustainability and grateful to those who were present in the audience. It starts with learning, and through strategic action, collaboration, and innovation, companies can make significant strides in reducing their environmental footprint and paving the way for a more sustainable future.

Is your company beginning its sustainability journey? No matter where you are in your journey, we’re here to help. Contact us today to get started.

The full audio recording of our SXSW 2024 panel on addressing hidden emissions is available here.

Yes, we held a panel on the convenient fantasies about climate change in 2022, and in 2023 we held a panel with leaders in the alcohol industry to gain insights into how each company is reducing their carbon footprints.

For our SXSW panels, CarbonBetter selects panelists based on their leadership in sustainability, innovative approaches to climate challenges, and their ability to provide actionable insights. We aim to represent a diverse range of industries and perspectives, ensuring that our discussions are well-rounded and informative for all attendees.