Can You Trust Your Carbon Accounting Data?

As climate-related disclosure and mitigation requirements continue to evolve, understanding the latest regulatory landscape is essential for US companies. In this webinar, we cut through the jargon to provide clear insights into emerging climate-related requirements, breaking down two key federal proposals and one EU regulation impacting some US-based companies. Join us to stay informed and prepared for what’s ahead in climate compliance.

How to ensure your organization’s data is accurate and reliable, and avoid the risks associated with bad data.

The International Data Corporation (IDC) predicts that by 2024 nearly 75% of large enterprises will implement Environmental, Social, and Governance (ESG) data management and reporting software as a response to emerging legislation and increased stakeholder expectations, with many likely to undergo an ESG audit in the next 12 to 18 months. Facing increasing consumer and investor demands for integrating sustainability into business operations, and potential new United States (US) and global climate disclosure regulations and recommendations, companies are turning to their technical teams to source and integrate data needed from stakeholders enterprise-wide to measure and report on climate-related impacts and risks. (Note: in this context, data is inclusive of both calculation inputs utilized to determine a company’s carbon emissions as well as the resulting emissions). But how accurate is that data, and what can be done to test and improve it?

What Is Carbon Accounting?

Greenhouse gas (GHG) accounting or carbon accounting is a process used by companies to quantify their GHG emissions as part of their non-financial sustainability reporting. Another term commonly used for quantifying GHG emissions is carbon footprinting. While there is no single, regulated standard, there are multiple frameworks and methods used to measure and track how much carbon an organization emits.

Gathering and Managing Data

As companies prioritize their sustainability efforts due to rising environmental regulations as well as pressure from consumers and investors, solutions for gathering and managing data will require collaboration across stakeholders, including but not limited to operations, accounting, environmental, health and safety (EHS), legal, procurement, and even 3rd party suppliers and vendors in the case of Scope 3 GHG emissions.

For companies that elect to implement a software solution to manage their sustainability efforts, Chief Information Officers (CIOs) and Information Technology (IT) professionals are becoming essential in helping organizations meet their sustainability goals. It’s important to note, there are a multitude of ways to configure data collection and calculation tools for carbon accounting ranging from data collection questionnaires and spreadsheets, to calculation workbooks, databases, and software solutions.

Each of these respective tools has varying complexity in terms of implementation, but ultimately the tools require subject matter expertise to ensure you are gathering the right calculation inputs, as well as setting up calculations and choosing emission factors that follow reputable protocols and data sources that best align with your industry and operations, while simultaneously meeting any regulatory drivers.

It’s more important than ever to set up business processes and identify key stakeholders to collect reliable, accurate and repeatable data from various sources across an organization, because some of the data needed, or the decisions about data that need to be made, for carbon accounting and other sustainability reporting is qualitative, not quantitative. If you do not have in-house sustainability expertise, engaging a 3rd party to support your data gathering and calculation efforts could be essential to ensuring accuracy and mitigating risk.

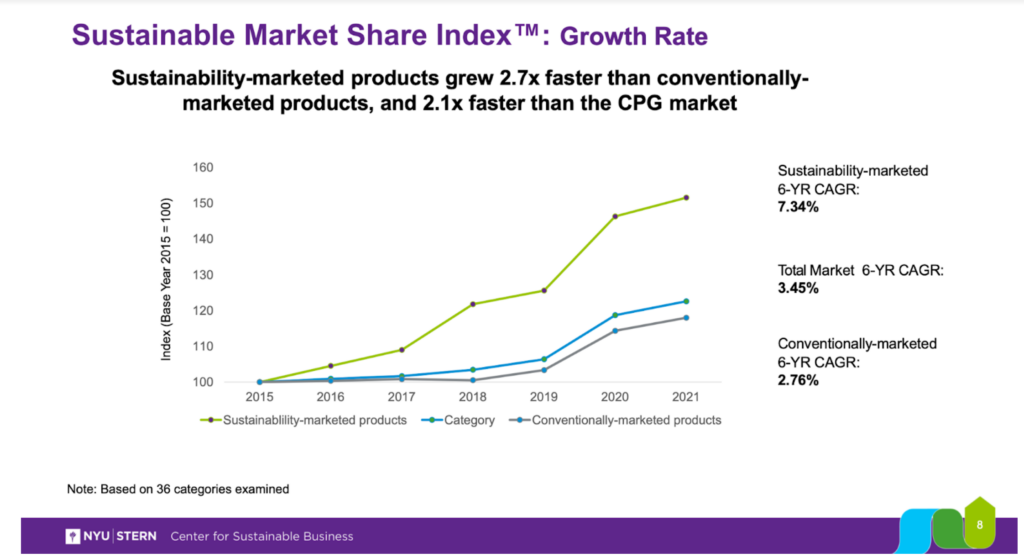

There are many different methodologies to follow when calculating your organization’s carbon footprint, and what’s considered material may vary from business to business as well as voluntary disclosure goals and/or regulatory disclosure requirements. All of this complexity leaves a lot of room for missing or inaccurate data, which can lead to real financial consequences, whether it’s due to a lack of transparency or from reporting material weaknesses. In contrast, research tends to show a positive correlation between implementing sustainability efforts and business growth.

Calculation Methodologies

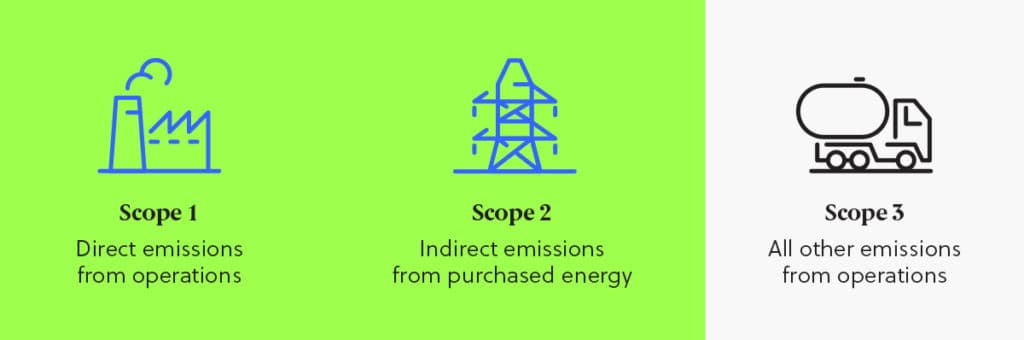

Carbon accounting measures a company’s GHG emissions across 3 “Scopes” or categories. Scope 1 emissions refer to direct emissions associated with combustion of fuels from equipment that a company or organization owns, inclusive of fleet vehicles. Scope 2 emissions refer to indirect emissions associated with electricity consumption on-site. Scope 3 emissions include all other emissions sources across the value chain including but not limited to supplier emissions and corporate travel.

There are a number of protocols, methodologies, and guidance documents that exist for quantifying and disclosing carbon emissions, including, but not limited to: the World Resources Institute’s (WRI’s) GHG Protocol, the CDP, formerly known as the Carbon Disclosure Project, the Sustainable Accounting Standards Board (SASB), as well as guidance from the United States Environmental Protection Agency (USEPA).

In cases where you are quantifying emissions and disclosing voluntarily, you have full latitude to choose protocol(s) and set the boundaries of your emissions calculations. In voluntary reporting, there is no rule that says you have to quantify and include Scope 3 emissions. In cases of regulatory drivers, rules may dictate which protocols and calculation methodologies must be followed to ensure consistency in reporting. Whether voluntary or mandatory, navigating and implementing the appropriate calculation methodologies requires technical expertise in carbon accounting.

If you have expertise in house, you may still want to seek 3rd party verification to ensure accuracy of your emissions calculations. Also, it’s important to note that some emerging regulations have provisions that require 3rd party verification.

“If your carbon accounting data is not accurate, it can impact investment decisions and access to capital as well as create reputational risk.”

Nicole Sullivan, former Director of Climate Services at CarbonBetter

SUSTAINABILITY REPORTING OVERVIEW

Sustainability reporting serves as a valuable tool to achieve corporate commitments and better manage climate-related business risks. This white paper walks you through what's typically included and what should be considered.

Risks of Bad Carbon Accounting Data

Companies relying on bad or inaccurate data to calculate their GHG emissions, which then correlates to inaccurate emissions estimates, may experience real negative consequences. Something to consider whether you are utilizing spreadsheets, databases, or a software solution to quantify your emissions: garbage in equals garbage out, no matter how robust your calculation tool. In cases where there is a regulatory driver in place which requires carbon accounting and disclosures, bad data and inaccurate carbon emissions leads to a compliance risk.

Research shows that companies reporting material weaknesses—which the Securities and Exchange Commission (SEC) defines as “a deficiency, or combination of deficiencies, in internal controls over financial reporting (ICFR) such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.”—may experience a drop in stock value or a loss of potential future investment capital as consumers and investors gravitate towards companies that implement business practices that seek to mitigate climate change.

The proposed SEC Climate Disclosure rule, anticipated to become effective in April 2023, seeks to standardize climate disclosure data and facilitate streamlined investment decisions. Per SEC Chair Gensler, “Today, investors representing literally tens of trillions of dollars support climate-related disclosures because they recognize that climate risks can pose significant financial risks to companies, and investors need reliable information about climate risks to make informed investment decisions.” If your carbon accounting data is not accurate, it can impact investment decisions and access to capital as well as create reputational risk.

Reasons For Bad Data

Sometimes bad or inaccurate data is due to an intentional lack of transparency. Some companies are fully transparent with consumers and investors about their carbon emissions and other environmental metrics through traceable sustainability reports that disclose where they are at today and their progress, while other companies lack that same transparency for fear that they might reveal business strategies or face backlash over the size of their carbon footprint. However, hiding this data can actually cause mistrust among consumers and investors, ultimately leading to a loss in revenue.

Another reason for bad or inaccurate data is due to the subjective nature of collecting and analyzing sustainability data. A lack of common standards that are centrally regulated means even when businesses mean well, at best everyone could be using a different measuring stick: between choosing what’s material for a given business, what data to include, the boundaries of your carbon footprint (Scope 1 and 2 only or Scopes 1, 2, and 3) and which methodologies to follow. When surveyed, nearly half of the 813 IT professionals who responded said their company could not accurately report its carbon footprint.

Even with positive intent and a desire to do things the right way, accuracy can be impacted by ineffective business processes and a lack of stakeholder engagement. Gathering data enterprise-wide to calculate your carbon footprint requires time and effort from stakeholders, often in tandem with competing priorities.

Common reasons for bad carbon accounting data include:

- Fractured planning and process

- Lack of access to data

- Lack of stakeholder engagement

- Lack of knowledge / preparation

- Lack of time and budget

Ensure Your Data is Accurate and Reliable

With a few simple steps you can ensure your organization’s data is accurate and reliable and that the carbon accounting processes put in place are repeatable. The first step is to streamline and centralize the process of gathering and managing carbon-related data. This will close as many data gaps as possible, while also ensuring everyone who needs it has access to the data. This should also help eliminate any double reporting that may exist. Next, education is critical. With so many variables, it’s essential that someone at your organization is ultimately responsible for staying up-to-date with the latest news, regulations and methodologies. This may mean training current employees or hiring to fill a new position. Finally, 3rd party support and verification is a good backstop to ensure your data is accurate and reliable and to avoid any risks associated with bad carbon accounting data.

Conclusion

Ultimately, more guidance and a standardized process are needed to help companies accurately and reliably measure their carbon footprint in a way that consumers and investors can reliably compare to other companies. Until then, stay as educated as possible, follow the best methodologies that are available, and maintain a high level of transparency with consumers and investors. We can help you no matter where you are in your sustainable journey. Contact us today to get started.

Ensuring high-quality carbon accounting data requires implementing best practices such as using standardized methodologies for data collection, validating data accuracy and completeness through quality control measures, and documenting any assumptions or uncertainties associated with the data. It is also essential to ensure that data is transparent, consistent, and comparable to other data sources, such as emissions inventories or industry benchmarks.

Technology can play a significant role in improving the quality of carbon accounting data by automating data collection processes, integrating data from various sources, and applying advanced analytical tools for data validation and verification. For instance, remote sensing technologies, such as satellite imagery, can be used to identify and track emissions sources in real-time. Similarly, blockchain technology can be used to create secure and transparent data-sharing networks, which can improve data accuracy and reliability.

There are several resources available to individuals and organizations seeking to improve their understanding of carbon accounting best practices and data quality. For example, the GHG Protocol developed by the WRI provides standardized methodologies and tools for measuring and reporting greenhouse gas emissions. The International Organization for Standardization (ISO) has also developed standards related to carbon accounting, such as ISO 14064, which provides guidance on the quantification, monitoring, and reporting of GHG emissions. The USEPA offers guidance on developing and implementing GHG inventories for organizations and municipalities. The Climate Disclosure Standards Board (CDSB) provides guidance on how companies can disclose climate-related financial risks and opportunities in their financial reporting. Finally, online courses and certifications such as those offered by the GHG Management Institute and the University of Edinburgh provide structured learning opportunities to gain knowledge and skills in carbon accounting and data quality.

About the Author

Pankaj Tanwar is Managing Director of Climate Services at CarbonBetter. He has experience leading Fortune 100 companies through their sustainability journeys, including sustainability driven growth in the food industry. Pankaj holds an MBA from Northwestern University’s Kellogg School of Management and a BTech in Mechanical Engineering from the Indian Institute of Technology, Kanpur.