Important Considerations for Carbon Offset Vintages

🌍 Carbon markets can feel overwhelming—fragmented data, limited transparency, and conflicting advice make it hard to know where to start. In this webinar, our experts give a clear, practical introduction to the VCM.

Certified Offset Portfolios

Buying high-quality carbon offsets has never been easier. Explore CBCO Portfolio 22-1 and get instant access to fully vetted carbon offsets.

Understanding carbon offset vintages is important for choosing the right offsets.

The United Nations Environment Programme (UNEP) identified a global “emissions gap” whereby entities must immediately decrease greenhouse gas (GHG) emissions by 7.6% every year if global warming is to be limited to the 1.5C target. To reach these goals, entities now strive to be “carbon neutral” or “net-zero.” A business is considered carbon neutral when its carbon reductions are equivalent to its carbon footprint. In efforts to mitigate climate change, carbon offsets have become a tool for carbon emitters to counterbalance their emissions in their efforts to reach net-zero targets. However, not all carbon offsets are created equal, and vintage—or the age of the offset—is a key consideration.

What are Carbon Offsets and Vintages?

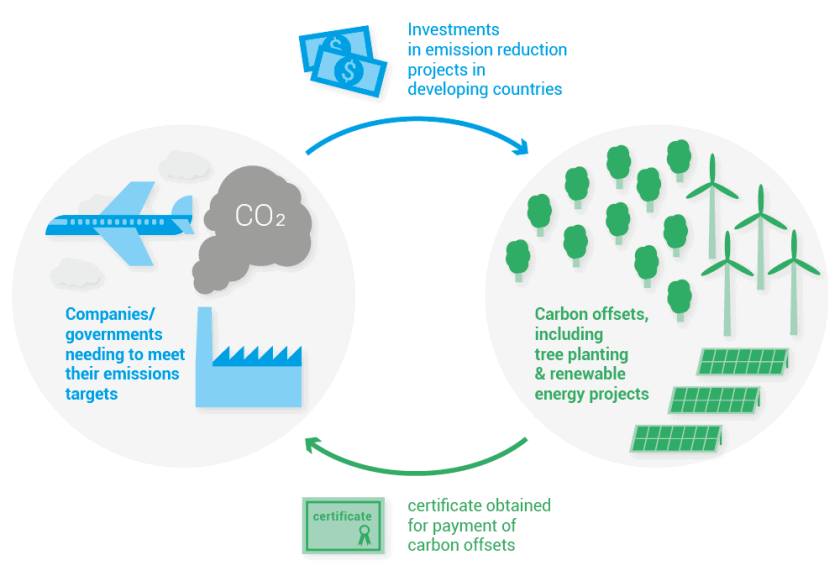

The terms carbon offset and carbon credit are often used interchangeably. Generally, carbon offsets are activities that compensate for carbon dioxide (CO2) emissions or other greenhouse gasses (GHGs) by providing for an emission reduction elsewhere. The certificate for a carbon offset is known as a carbon credit, which represents one metric ton (2,205 lbs) of CO2 emissions and has a monetary market value.

Carbon credits are transferable financial instruments certified by a registry and with third-party verification that ensures the credit reduces or sequesters one metric ton of CO2 or another amount of GHG elsewhere. The funds generated from the sales of carbon offsets often finance other carbon emission-reduction projects.

Image courtesy of unep.com.

Carbon offset projects can include, but are not limited to, renewable energy generation, carbon capture, carbon storage, destruction of powerful GHGs, avoided deforestation, and land rehabilitation projects. An example of a carbon offset project is a dairy farm installing an anaerobic digester to capture and destroy methane—a powerful GHG that causes global warming—that would otherwise be released by a cow into the atmosphere. Carbon offset projects can be small-scale and only reduce a few hundred tons of carbon-dioxide equivalent (CO2e) per year, to very large and offset millions of tons per year.

Eco-conscious companies and consumers can buy carbon offsets directly from organizations that certify carbon offsets through a third-party verifier so they can reduce their carbon footprint for their activities, such as company operations like manufacturing and distribution, or even driving a car or flying on an airplane. Voluntary carbon markets include the American Carbon Registry, Climate Action Reserve, and The Verified Carbon Standard, to name a few examples. CarbonBetter helps clients secure the best quality offsets at the best prices across all registries, and curates carbon offset portfolios for instant access to fully vetted credits.

Ready to Talk About Your Sustainability Goals?

Get tailored sustainability solutions that meet your business’s unique needs. CarbonBetter delivers tomorrow’s climate solutions—today. Contact Pankaj Tanwar, Managing Director of Climate Services, to get started.

Not ready yet? Read our client stories to see what it’s like to work with us.

Why Vintage Matters

Much like fine wine, a carbon offset’s “vintage” is the year an emission reduction occurred or the offset was issued. The vintage of a carbon offset can have an impact on its quality and pricing. Generally speaking, the older the vintage, the cheaper the price per credit will be.

Carbon offset vintage matters for a number of reasons. The protocols and monitoring methodologies have improved over time and have become much more rigorous, so the quality of carbon offsets has generally gotten better—there’s typically more confidence in a ton of carbon that’s been registered more recently. For older vintages, can we confidently say that the carbon credit really represents a metric ton of CO2, as verified? While that may have been true at the time of verification, perhaps new standards in use would not agree.

Older vintages may trigger quality concerns when the carbon credits remain unsold for a long time. Additional concerns arise if the developer has not gotten the credits third-party verified and has a large number of unsold credits.

There’s risk when buying up older vintage credits that they may not be effectively reducing emissions as intended if the project does meet current quality criteria.

Vintage Trade-offs

Carbon credit vintages do have some trade-offs. It is often cheaper to buy older offsets because the vintage year does typically affect the price. Often, offsets with an older vintage can be bought at a discounted price, so if you have budget constraints or there are supply issues due to current demand for carbon credits, offsetting with an older vintage credit is still making progress and is better than not offsetting at all despite questions about the environmental value of purchasing “legacy” carbon credits.

When purchasing an older vintage carbon credit, you can review if the credit aligns with current best practices and standards—some older vintage credits were still measured with rigor and not all credits are created equal. Just because older offsets may be cheaper does not mean that more expensive newer offsets are necessarily better quality—all dimensions should be considered.

Vintages Best Practices

While important, carbon offset vintages are just one dimension of a carbon offset that should be considered when shopping. Other considerations include the price per ton, verification standard, additionality, leakage, quantification methodologies, geography, technology, impact on local communities, and whether it’s made broader environmental damage. Even higher-priced, newer carbon credits may not have the best carbon offset return or desired GHG mitigation, so it’s critical to have the right help when navigating the carbon markets.

Thinking about buying carbon offset credits? Here are a couple of best practices to keep in mind.

- Find carbon offsets with a vintage that is within a few years of your GHG emissions. Typically, those issued between 1-3 years of the emissions to be canceled are the most desirable, whereas those with a vintage of 5 years or greater are less desirable.

- Don’t use vintage as the only criteria when shopping—consider vintage within the context of other factors such as its co-benefits for economic, social, and environmental sectors. These co-benefits can include additionality, job creation, renewable energy generation, biodiversity enhancement, restoration of land and forests, gender empowerment, pollution mitigation, access to education, and more. Quality offset projects should have these co-benefits listed so you can see exactly how the project benefits certain goals, such as the United Nations Sustainable Development Goals (SDGs).

Not sure where to begin? Get expert help to guide you so you can buy the best carbon credits. Carbon Better sources quality offsets for you so you will get the most out of your purchase and help you transition to a net-zero future.

No. Carbon offsets do not expire, but credits must be “retired” once a person or organization claims the environmental benefit. This ensures that the carbon sequestration or avoidance is not counted or claimed more than once. The standards and protocols used to measure effectiveness are constantly being updated to provide the most accurate estimates possible, so it’s possible that older vintages may offer fewer environmental benefits than newer vintages. That’s why it’s typically recommended to buy newer offsets when possible. CarbonBetter helps clients navigate the complexities of the carbon markets, including considerations of what vintage makes sense based on your organization’s goals.

No. However, it is recommended to try and buy carbon offsets within 1-3 years of your organization’s greenhouse gas (GHG) emissions, and anything more than five years apart is much less desirable. The CarbonBetter team helps organizations source carbon credits that meet specific technology, geography, and vintage criteria.

Usually, but not always. Typically, as time goes on, standards and protocols used to measure one metric ton of offset carbon in a project type can improve and become more accurate than previous methods. However, that’s not necessarily always the case. Some older vintages may have followed more rigorous standards than were required at the time, or perhaps the protocol has not changed, and now the carbon credit reflect the same environmental benefits as more recent vintages. Offsets with older vintages are often cheaper. So if budget is a constraint, purchasing older vintages can allow you to start progressing on your sustainability goals for now. It’s important to consider all of the elements of the transaction as a whole to determine if a particular vintage and carbon credit is right for your organization.

About the Author

Pankaj Tanwar is Managing Director of Climate Services at CarbonBetter. He has experience leading Fortune 100 companies through their sustainability journeys, including sustainability driven growth in the food industry. Pankaj holds an MBA from Northwestern University’s Kellogg School of Management and a BTech in Mechanical Engineering from the Indian Institute of Technology, Kanpur.