Ask Us Anything: About Carbon Markets Webinar Recap

Certified Offset Portfolios

Buying high-quality carbon offsets has never been easier. Explore CBCO Portfolio 22-1 and get instant access to fully vetted carbon offsets.

Closing the Carbon Market Gap

According to Bank of America, carbon offset supply may need to grow as much as 50x by 2050 to achieve net-zero emissions. Watch the replay as three experts discuss efforts to close this gap and the challenges in developing projects and issuing credits at scale.

Understanding the VCM and how intermediaries simplify carbon credit sourcing and quality.

The Voluntary Carbon Market (VCM) allows businesses and individuals to take climate action by supporting projects that reduce, avoid, or remove greenhouse gas (GHG) emissions. Despite its promise, navigating the complexities of the VCM can be daunting. In our recent webinar, “Ask Us Anything: About Carbon Markets,” moderated by Pankaj Tanwar, Managing Director of CarbonBetter’s climate services team, CarbonBetter’s former Director of Business Development and carbon market expert, Dominic Sung, addressed some of the most pressing questions about the VCM and explained the critical role intermediaries play in simplifying the process. In this post, we’ll provide a recap of the key takeaways.

Watch the full video replay.

What is the purpose of the Voluntary Carbon Market (VCM)?

The VCM provides a decentralized marketplace where businesses, individuals, and organizations can voluntarily buy and sell carbon credits. Businesses and individuals use these credits to invest in projects that reduce, avoid, or remove carbon dioxide (CO2) from the atmosphere. The VCM is a critical economic system for funding climate technology and emissions-reduction projects that might not receive support through other means. It enables participants to voluntarily contribute to meaningful climate solutions, helping to drive innovation and climate action.

What are some challenges in the current VCM environment?

The VCM faces several challenges that complicate participation:

- Lack of Price Transparency: There is no centralized marketplace or formal price-reporting system, making it difficult for buyers to assess fair value.

- Fragmentation: The market’s decentralized structure leads to inconsistent standards, registries, and frameworks, which creates confusion.

- Quality Assurance: Buyers often need help determining the quality of carbon credits due to the lack of standardization and the bespoke nature of many transactions.

Together, these factors make it harder to scale the VCM effectively.

What role do intermediaries like CarbonBetter play in the VCM?

Intermediaries bridge gaps in the VCM by providing access, transparency, and liquidity. CarbonBetter, for example, serves as a facilitator for buying and selling carbon credits. This role goes beyond brokering deals—it involves sourcing projects from a vast network of developers, intermediaries, and registries, giving clients access to diverse options without being limited to a single developer’s offerings.

Intermediaries also simplify the documentation and onboarding process, leveraging existing relationships and years of diligence to make the market more accessible to buyers. This streamlined approach removes the need for buyers to manage numerous counterparties and allows them to focus on aligning credits with their sustainability goals. Additionally, intermediaries provide critical market data, helping buyers navigate fragmented pricing structures and identify credible options.

Why is it difficult to know who can sell project issuances?

The lack of a public ledger that tracks who holds carbon credits adds complexity to the VCM. While registries record issued and retired credits, they don’t show who currently holds them. Many project developers pre-sell their credits to investors or long-term offtakers to secure financing, which means the credits may change hands multiple times before reaching buyers. This lack of transparency can make it challenging for participants to determine who has the authority to sell specific credits.

“Intermediaries bridge gaps in the VCM by providing access, transparency, and liquidity. … This role… involves sourcing projects from a vast network of developers, intermediaries, and registries, giving clients access to diverse options without being limited to a single developer’s offerings.”

Dominic Sung, former Director of Business at CarbonBetter

Skip the RFP—CarbonBetter can help

CarbonBetter Certified Offset Portfolios allow carbon buyers to participate in a variety of projects, geographies, and technologies in one simple transaction rather than navigating a lengthy and complex RFP process with multiple carbon market participants.

Learn More about CBCO 22-1Why can’t project developers access traditional financing for carbon projects?

Carbon projects often operate under standalone companies, which typically lack balance sheets or credit histories. This lack of financial history and stability makes them ineligible for traditional financing. Additionally, the absence of a forward pricing curve for carbon credits prevents developers from hedging against future risks, further deterring traditional lenders. Without these financing options, developers must rely on investors or long-term offtake agreements, where credits are pre-sold to secure upfront funding. While this approach helps projects progress, it shifts ownership and complicates market participation.

How do intermediaries help with price transparency in a market with fragmented data and wide bid-ask spreads?

Corporate buyers often engage with the VCM sporadically, making it difficult to track market trends or identify fair pricing. Intermediaries, however, are entrenched in the market daily and provide a clearer view of pricing and project availability. Unlike data services that rely on speculative bids and offers, intermediaries like CarbonBetter analyze actual transaction data across a broad portfolio. This level of insight allows buyers to make informed decisions and access real market intelligence.

Do intermediaries only add margins for information or do they offer other essential services that justify their role?

Intermediaries do far more than add margins—they provide critical services that justify their role in the VCM. Investors and long-term offtakers often take on significant financial risk when prepaying for credits. Intermediaries help manage these risks by maintaining market liquidity and ensuring buyers can access high-quality projects. They also guide buyers through the complexities of the market, from evaluating quality criteria to sourcing the right projects for their specific goals.

What causes the price difference between project developers and buyers?

Price differences reflect the risks assumed by early investors and offtakers who prepay for credits before they are issued. These investors often accept multi-year risks with no guarantee of issuance and may require higher returns to offset potential losses. Additionally, intermediaries add value by sourcing credits, guiding buyers on quality, and providing liquidity, which can impact pricing but is essential for ensuring a functional marketplace.

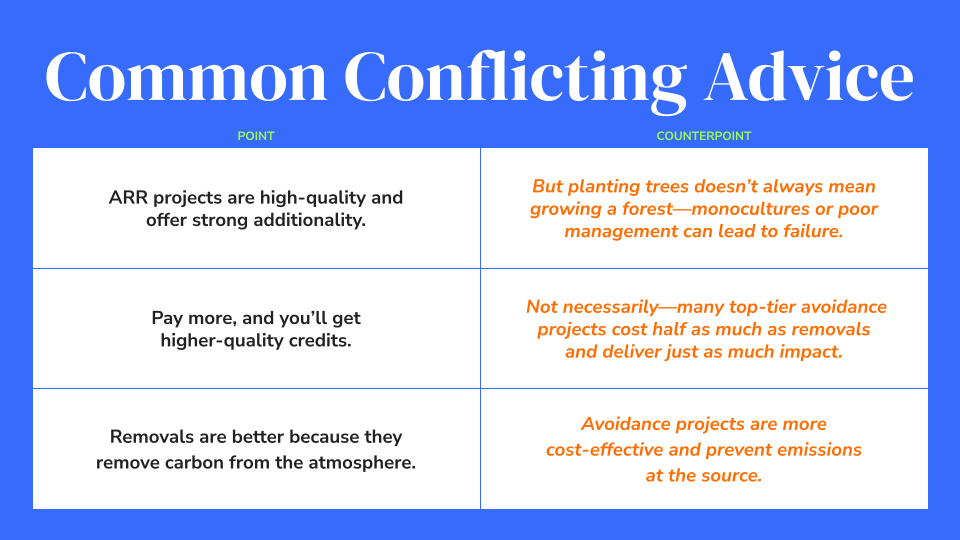

What are some common conflicting opinions about the VCM?

Conflicting advice can create confusion for buyers. For instance:

- Technology vs. Nature-Based Solutions: Opinions vary on whether energy-intensive solutions like direct air capture (DAC) are better than nature-based options like afforestation.

- Removals vs. Avoidance: While removals physically remove carbon, avoidance projects often prevent emissions at the source and can be more cost-effective.

- Price Equals Quality: Higher prices don’t always guarantee better quality, as many top-tier avoidance projects deliver a strong impact at lower costs.

The market’s complexity requires buyers to evaluate these nuances carefully, as overly simplistic advice can lead to misinformed decisions.

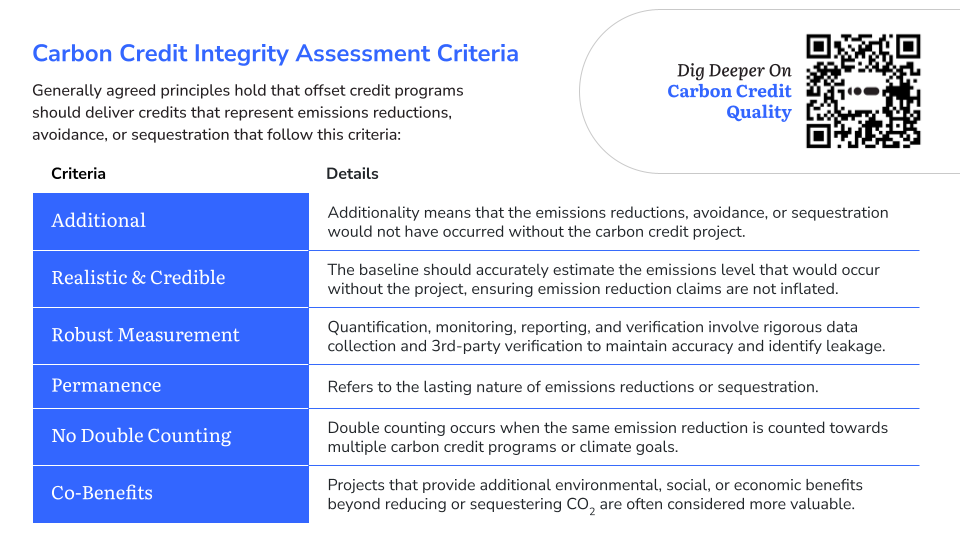

How can buyers ensure they are purchasing high-quality credits?

Quality begins with defining clear criteria. Buyers should align their standards with objective measures such as additionality, permanence, and traceability, as well as subjective preferences like geographic alignment or co-benefits. Intermediaries can help buyers navigate these criteria, ensuring they source credits that meet both objective and subjective definitions of quality.

Is purchasing from a recognized registry enough, or should buyers conduct further due diligence?

It’s always important for buyers to conduct their own due diligence. While being listed on a reputable registry clears a major hurdle, further evaluation is essential to ensure a project aligns with the buyer’s specific quality criteria. Blanket trust in any single source is never prudent—taking the extra step to investigate a project’s fit with your goals and standards is always worthwhile.

Should companies prioritize removals over avoidance?

It depends on corporate goals and preferences. While removals address atmospheric carbon directly, avoidance projects often offer cost-effective solutions by preventing emissions at the source. A portfolio approach that balances both types of projects allows companies to maximize impact while aligning with their sustainability strategies.

What’s the best way to talk about carbon credits once purchased?

Transparency and traceability are essential. Companies should clearly explain why they chose specific projects, how these align with their sustainability goals, and the impact they aim to achieve. This approach builds trust and demonstrates thoughtful decision-making.

What trends should companies be aware of as they navigate the VCM?

The VCM is evolving, with a growing emphasis on quality and transparency. Trends include a flight to quality, the introduction of credit insurance, and a shift toward grant-based funding for early-stage projects. For the market to scale, it must lower barriers to entry, improve consistency, and ensure rigor, making it an exciting time to participate in and shape the VCM.

Conclusion

The Voluntary Carbon Market (VCM) enables businesses to take actionable steps toward climate solutions by supporting projects that reduce, avoid, or remove CO2 from the atmosphere. However, navigating its complexities requires expertise. By partnering with intermediaries like CarbonBetter, buyers can access high-quality projects, ensure transparency and traceability, and align their purchases with their sustainability goals.

Navigating the VCM doesn’t have to be overwhelming. Whether you’re looking to source high-quality carbon credits, define what “quality” means for your organization, or ensure your purchases align with your broader sustainability strategy, CarbonBetter can guide you every step of the way. Contact us today to get started.

At CarbonBetter, we believe in progress over perfection. It's not about doing everything—it's about doing something. With over a decade of experience in the energy industry, we partner with organizations to guide them in the transition to a net-zero economy. CarbonBetter's sustainability specialists work closely with partners across all industries to integrate sustainability solutions seamlessly into any business.

CarbonBetter helps organizations of all sizes measure, reduce, report, and offset their emissions, and tell stories about their sustainability journey.

Telling stories about sustainability efforts helps other organizations take action that will then, in turn, inspire others—it's never too early or late to start.