PE and VC’s Largest Roadblocks to Sustainability, Responsible Investing and Decarbonization

SUSTAINABILITY REPORTING OVERVIEW

Sustainability reporting serves as a valuable tool to achieve corporate commitments and better manage climate-related business risks. This white paper walks you through what’s typically included and what should be considered.

PE and VC firms must navigate six common roadblocks to effectively integrate sustainability, responsible investing, and decarbonization into their strategies.

Private equity (PE) and venture capital (VC) firms today deal trillions of dollar value annually, with global fundraising reaching $649 billion and assets under management at a substantial $8.2 trillion in 2023, notwithstanding the challenging fundraising backdrop in recent years. Given the industry’s material impact on the world, endorsements for and conversation around sustainability and responsible investing have noticeably escalated for both leading and emerging general partners (GPs) and climate change is an increasingly critical deal driver worldwide.

Sustainable value creation, responsible investing and decarbonization cannot be accomplished by general partners alone; leading and emerging firms today need to level-set with varied internal and external stakeholders and be conscious of the most common, prevalent roadblocks to sustainability.

Most private firms and asset managers now recognize that attitudes towards sustainable investing and environmental, social or governance (ESG) issues have drastically shifted in the last decade, necessitating firm-level commitment and action to reduce their firm and portfolio’s emissions. Rising expectations and pressures from investors, employees, regulators and portfolio company customers have compelled many firms to prioritize sustainability in their operations and investment policy. Accordingly, the UN Principles for Responsible Investing (PRI) reported a fourfold increase in private equity and venture capital managers joining the initiative between 2018 and 2022, with nine of the top ten global general partners being PRI members and 28 of the largest 70 U.S.-based PE firms being signatories.

While it is evident that firms are increasingly committing to sustainability and incorporating ESG in their investment philosophy, many PE and VC firms fail to understand that responsible investing and decarbonization cannot be accomplished by GPs alone. Today, GPs must collaborate with stakeholders, portfolio companies, and external subject matter experts to successfully integrate sustainability into their strategy and implement ESG and decarbonization initiatives.

Here, we highlight six potential roadblocks that most often limit general partners and investors from effectively integrating sustainability, responsible investing and decarbonization into their strategy and an overview of how to navigate these obstacles.

Roadblock #1: Misalignment Between the Firm and Its Stakeholders on Sustainability Strategy, Materiality, Constraints, and Goals

Before rushing ahead with strategy implementation, general partners and firms must take a step back and ensure that their firm and stakeholders are onboard and fully aligned with strategy on sustainability, decarbonization and/or ESG. Any strategy, no matter how comprehensive or thorough, is certain to fail without the support of internal and external stakeholders and alignment on what is material and priority for them.

Whether through a dedicated sustainability or ESG team or relevant internal stakeholders willing to champion sustainability or ESG within the firm, GPs must conduct an initial materiality assessment and level set the findings across relevant stakeholders. GPs must be able to communicate where their firm currently stands in terms of sustainability/ESG implementation, being transparent on how their firm is performing compared to peers and what works for them versus needs improvement. GPs should also be candid to stakeholders about any limitations or constraints that are preventing progress – these may be conflicting policies or pushback from their portfolio companies. Finally, PE and VC firms should ensure that their stakeholders are both aware and supportive of the specific material issues, goals and objectives that are set.

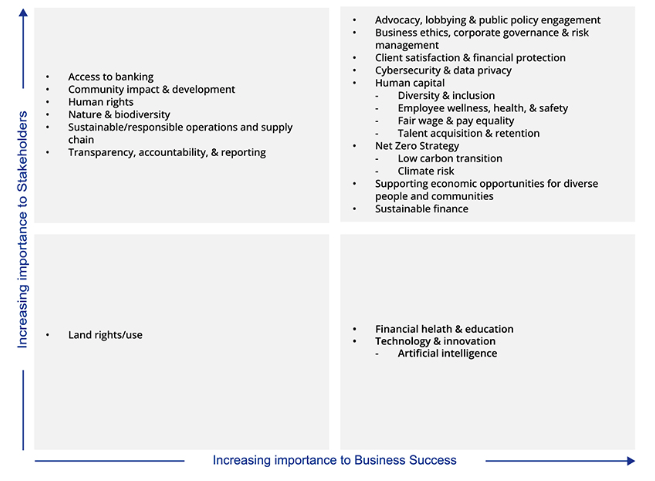

Leveraging a Materiality Assessment

A highly effective and widely adopted approach to align on materiality, standings, constraints and goals is to conduct a materiality assessment. A properly conducted materiality assessment not only helps GPs and investors identify and prioritize the most important sustainability and ESG issues to their firm and stakeholders but also highlights potential risks and opportunities for both their firm operations and portfolio. The process should also include comprehensive and diverse stakeholder engagement in the form of interviews, surveys, workshops and meetings.

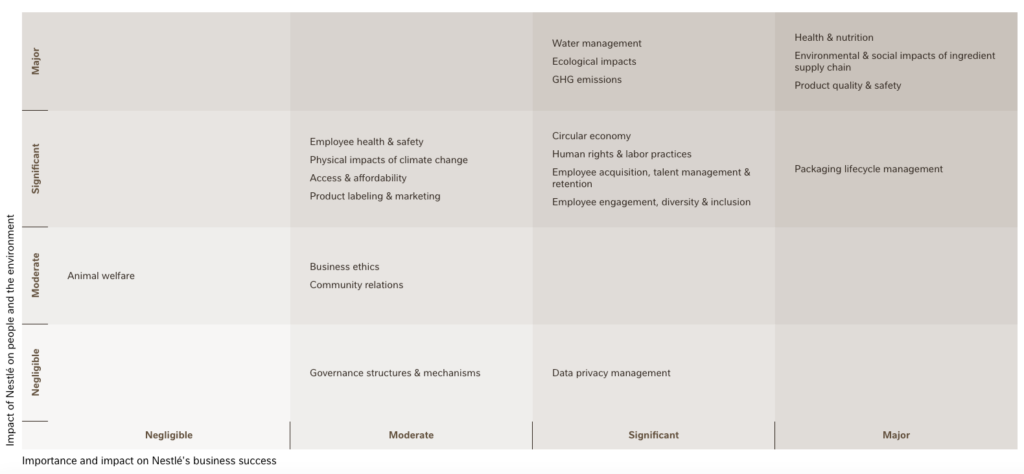

After conducting the materiality assessment, GPs should then thoroughly review the resultant materiality matrix, which summarizes and prioritizes various material sustainability and ESG issues that matter most to their firm and stakeholders. It should be noted that one PE or VC firm’s materiality matrix may look completely different from that of another firm, given the diverse industries each GP invests in, and their varying operations and stakeholder preferences. Note the following case studies of varying materiality matrices: Nestle, a major consumer goods firm and Bank of America, a leading investment bank and financial services firm. These case studies illustrate how sustainability priorities differ widely across industries. Once GPs have completed this materiality process, they can be assured that any next steps and action plans are aligned with what their stakeholders deem material and priority items for the firm.

Case Study: Bank of America’s Materiality Matrix

Source: Our approach to ESG priorities, Bank Of America, July 2024

Case Study: Nestle’s Materiality Matrix

Source: Materiality – identifying key sustainability issues, Nestle, July 2024

Roadblock #2: Failing to Understand Institutional Investors’ and Allocators’ Sustainability/ESG Priorities and Considerations

To most private markets and capital firms, institutional investors and allocators are a major stakeholder group that drives a firm’s fundraising success. Most GPs cannot afford to neglect the various asks and priorities of their investors and limited partners (LPs), which increasingly emphasize sustainability, decarbonization and ESG implementation. When GPs fail to focus on what their investors and LPs deem material, their firms will likely fail to make progress on their sustainability agendas.

Institutional investors and allocators today increasingly request from GPs an heightened level of environmental, social and governance-related responsibilities and prioritize ESG, decarbonization and sustainability within their GP selection and fund-allocation process. According to PwC’s 2023 Global Investor Survey, three-quarters of investors consider sustainability important in their investment decisions, and 81% of institutional investors in the U.S. plan to increase their ESG allocations in the next two years. Morgan Stanley’s 2024 Wealth Management survey reports that in the past two years, 57% of investors have seen their interest in sustainable investing grow, and 54% plan to increase their sustainable investments in the coming year. In the U.S., climate change was cited as the most significant driver of increased interest in sustainable investing.

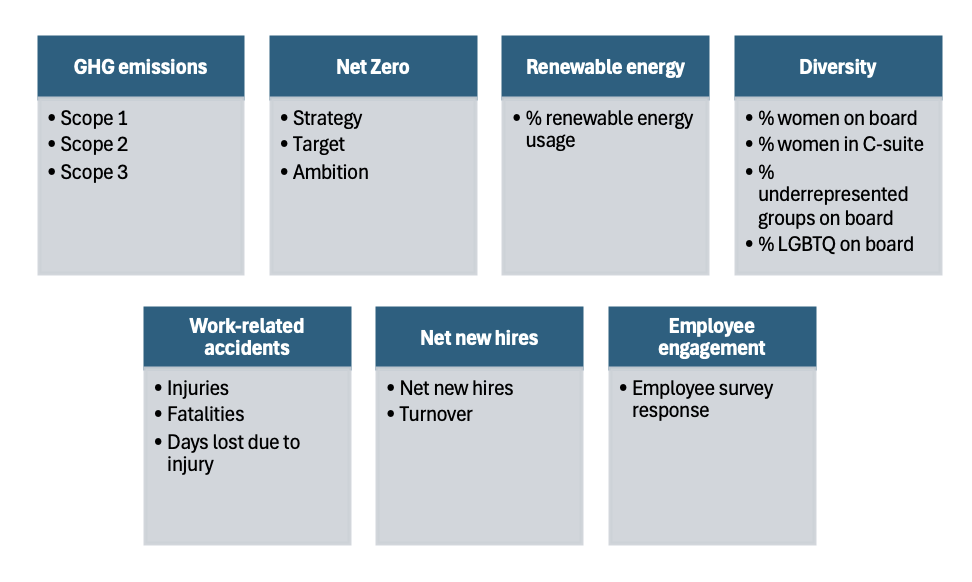

Today, there are multiple industry initiatives, regulations and frameworks that highlight which metrics and sustainability data that investors and limited partners are requesting and will continue to request from their GPs, such as the UN PRI, TCFD, ESG Data Convergence Initiative (EDCI). The EDCI, created to drive convergence around a standardized set of ESG metrics and a mechanism for comparative reporting in the private markets, provides firms with a streamlined set of reporting criteria drawn from existing frameworks. The below diagram provides an overview of the EDCI’s data categories and metrics.

Source: ESG Data Convergence Initiative

By having a strong grasp of what their investors are prioritizing and requiring from their GPs, private equity and venture capital firms are less likely to encounter roadblocks related to data collection, monitoring and reporting and more likely to have the backing and support of their LPs on their sustainability and ESG strategy.

Roadblock #3: Neglecting to Involve Portfolio Companies Early and Provide a Clear Call to Action

It is challenging, if not impossible, for GPs to implement their sustainability and ESG strategies without the support and action of their portfolio companies. For most GPs, the emissions and environmental impact of their portfolio companies are included in the firm’s own Scope 3 emissions, per the GHG Protocol’s definition of Scope 3 Category 15 (Investments). In this sense, the firm’s portfolio companies’ carbon footprint is considered as part of and consequently increases the GP’s carbon footprint, compelling GPs to reduce the emissions of their portfolio to mitigate risk.

However, getting portfolio companies to accept and implement their private equity or venture capital partner’s strategy can be challenging due to several factors. Depending on the portfolio company’s maturity level, operational resources, industry or sector, geographic location, leadership perspectives and whether the PE/VC partner has a controlling or majority stake in the company may all influence the level of participation and support for sustainability and ESG. For instance, a startup may focus on rapid growth over sustainability, while a mature company might be more receptive to ESG initiatives due to higher investor or regulatory pressures.

Moreover, collecting consistent and comprehensive ESG data from portfolio companies often poses difficulties. Some portfolio companies may need more infrastructure, internal resources or subject matter expertise to track and report relevant metrics, requiring GPs to troubleshoot issues and leverage their limited social capital to encourage cooperation.

Finally, achieving alignment requires GPs to understand the unique operational constraints and supply chain limitations that their portfolio companies face, and to propose realistic and achievable sustainability, decarbonization and ESG actions.

Given these challenges, early engagement with one’s portfolio companies is crucial, and it is far-reaching to align together on an appropriate number of feasible targets and action items, rather than overwhelming them with an unrealistic list of needs and wants. Establishing a sense of urgency with clear timelines, deadlines, roles and accountability can help implement a firm’s sustainability/ESG strategy effectively, ensuring their portfolio company partners are committed to the same goals.

“Private equity and venture capital firms cannot achieve sustainability and decarbonization goals alone. Aligning with internal and external stakeholders, understanding investor priorities, and leveraging external expertise are crucial steps for meaningful progress.”

Della Jung, Director of Business Development at CarbonBetter

FW Sustainability Report

Learn more about how Fierce Whiskers has made sustainable choices every step of the way by downloading its full sustainability report.

Roadblock #4: Failing to Keep up With the Regulatory Landscape and Reporting Requirements

As demand from investors and other stakeholders for sustainability, decarbonization and ESG-related information grows, the relevant regulatory landscape is also evolving rapidly with new waves of disclosure and reporting rules increasingly affecting GPs and their portfolio.

Today’s plethora of varying frameworks, guidelines, regulations and laws may be overwhelming for many GPs that are attempting to formulate their reporting strategies and standards. Some of these rules and requirements mandate that firms and their companies disclose certain risks or metrics that could have a material impact on their business, financial condition, or results of operations, including quantitative and qualitative information.

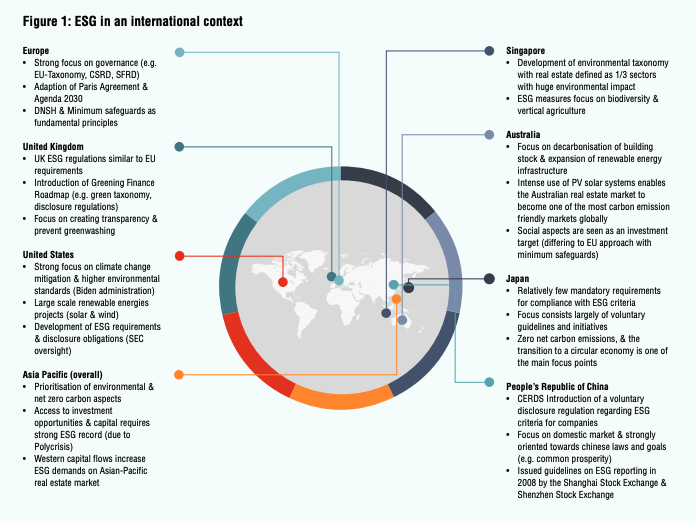

Understanding how regulations differ between regions is also challenging for GPs operating across multiple countries. Per the below diagram from a recent UN PRI report, each jurisdiction differs widely in their focus and level of regulatory pressure, with Europe generally leading in governance and stringent regulations.

Source: Mapping ESG: A Landscape Review of Certifications, Reporting Frameworks, and Practices, UN Principles For Responsible Investment, 2023

Leveraging a Gap Analysis

Given the complex regulatory background, an effective exercise for GPs to complete is a gap analysis against specific frameworks or regulations. By conducting this exercise via an internal subject matter expert or an external partner, firms can understand where the existing gaps are between their current reporting and what is required by their regulators, jurisdictions or stakeholders. For many firms, a gap analysis may highlight glaring gaps in Scope 1, 2 or 3 emissions data for their firm and portfolio or other critical metrics and disclosures. After the exercise, GPs can digest the expert advice on what to prioritize and take action on tangible recommendations to close gaps.

Roadblock #5: Overlooking Peer Strategies and Successful Case Studies

Benchmarking and monitoring is essential for GPs to evaluate their sustainability programs against industry peers and competitors. This involves comparing reporting and disclosures, level of transparency, and performance metrics, to identify areas for improvement and maintain investor and stakeholder confidence. By failing to benchmark and digest successful case studies, many GPs and firms make mistakes they could easily avoid, wasting valuable time and resources for implementing sustainability, decarbonization and ESG.

How to Conduct Benchmarking and Peer Analysis

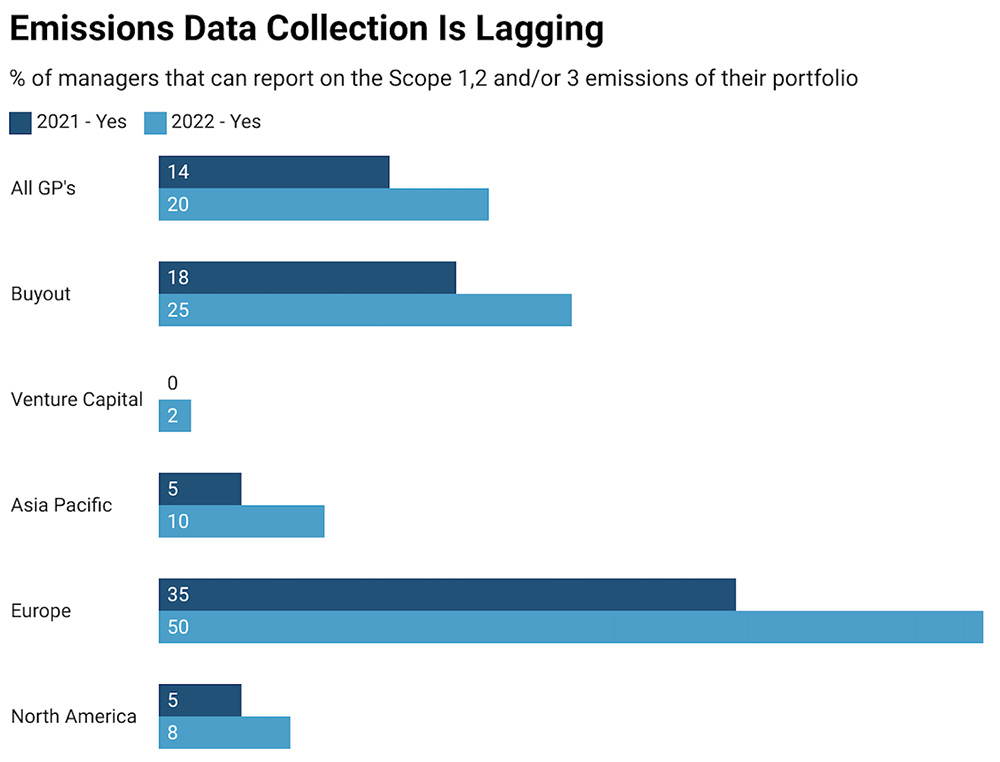

An effective opportunity for GPs to accelerate their reporting efforts and frameworks alignment is to conduct a benchmarking and peer analysis. By doing so, GPs can summarize and take action on the relevant reporting requirements most pertinent to their firm, operations, portfolio companies, investors and stakeholders, without second-guessing. A typical benchmarking and peer analysis may take into consideration six to nine of one’s peers and competitors to see what and how they report and the varying industry norms. Conducting this exercise may point to how much or little other managers are reporting, providing insights on future reporting and resource allocation. Per below chart, today’s PE and VC managers increasingly collect portfolio-level Scope 1, 2 and 3 emissions data, being pressured by the heightened reporting standards of their peers and competitors.

Source: Adam's Streets Annual General Partners Survey 2023, Adams Street Partners, 2023

One benchmarking strategy is to compare the GP against industry-wide initiatives and peer networks, such as the ESG Data Convergence Initiative (EDCI) or Net Zero Asset Managers Initiative (NZAMI) members. By benchmarking the firm and analyzing differences in the aggregate data, metrics and reporting, GPs can benchmark their progress against the wider private investment industry and their peers.

Another effective method is to monitor, analyze and adopt successful case studies. For instance, carbon offsetting and investment in carbon removals is an effective decarbonization strategy increasingly adopted by leading GPs to meet their climate and sustainability goals:

- J.P. Morgan Private Equity Group – The firm’s private equity arm has committed substantial resources to carbon removal projects. In May 2023, the firm committed funding to long-term contracts to remove and store 800,000 tonnes of carbon dioxide. The investment supports the carbon removal sector and helps JPMorgan offset hard-to-abate emissions by 2030.

- Hg Capital - For FY23, Hg Capital compensated for its carbon emissions by offsetting its Scope 1, 2 and 3 emissions through two projects: a Refrigerant Destruction project focused on the collection, control, and destruction of potent non-CO2 greenhouse gases, and a Malawi High Efficiency Cookstoves project to distribute improved cookstoves to displace open-fire cooking.

- EQT - Since 2020, EQT has offset its carbon footprint by investing in frontier technologies such as bio-oil and concrete mineralization, complementing more conventional investments in reforestation projects and wind farms.

Roadblock #6: Not Knowing When to Leverage In-House vs. External Subject Matter Expertise

For many GPs, it may not make sense to invest in a full-scale team covering sustainability, decarbonization and ESG, if they can borrow enough hours from the relevant internal experts, who may sit in other functions such as investor relations, compliance, legal or operations. However, in cases where internal expertise or bandwidth is lacking, GPs should consider the potential value add of external subject matter expertise and consultant support. Failing to leverage and take advantage of external support can be a roadblock that prevents progress in the interim.

Given the need to allocate valuable firm resources efficiently, it is often impractical to drive sustainability, ESG or decarbonization projects in-house. Developing a full-scale in-house team is an approach most common with large-cap funds, while it is less suited for mid-market or emerging firms. Many firms and GPs successfully outsource some of their ongoing sustainability, ESG or climate-related reporting, monitoring and program implementation functions to third-party subject matter experts, in order to avoid overburdening their internal teams. By optimally utilizing external consultants firms can maximize value creation and drive significant impact.

From a materiality assessment to identify and prioritize the most important sustainability and ESG issues, a gap analysis to understand discrepancy between current reporting and what is required by regulators, jurisdictions or stakeholders, a benchmarking and peer analysis to summarize and take action on evolving industry norms and relevant reporting requirements, carbon accounting inclusive of Scope 1, 2 and 3 emissions calculations and verification and carbon offsetting to neutralize some or all firm-level or portfolio-level emissions, third-party subject matter experts like CarbonBetter can help GPs scale up and train their sustainability and ESG functions, build up their internal capabilities and advance their overarching strategies in cost-effective and value accretive way.

Conclusion

What most commonly limits GPs from making progress in their sustainability, decarbonization or ESG journey is not knowing where to begin or the next steps. They become further constrained when faced by common roadblocks such as a misalignment of priorities between the firm and its stakeholders, failing to understand their investors’ priorities, not involving their portfolio companies early, failing to keep up with the shifting regulatory landscape, neglecting peer strategies and successful case studies and not knowing when to leverage external subject matter expertise.

From deciding which sustainability and ESG frameworks to prioritize, what and when to report to investors, which metrics and data to collect and monitor and how and when to coordinate with other stakeholders, GPs are faced with countless questions and decisions. By consulting with an external subject matter expert like CarbonBetter, firms can understand what action items should be prioritized and how to execute these steps to make the progress they need.

CarbonBetter works with private equity and venture capital firms, their portfolio companies and investments, alternative investors and the private markets as their

trusted partner in sustainability, decarbonization, the carbon markets, and net-zero strategy and implementation. From materiality assessments, carbon accounting and verification, gap analysis, benchmarking and peer analysis and carbon offsetting services, we support our clients to scale up and advance their sustainability, ESG, responsible investing and decarbonization strategies. Please reach out to Della Jung to learn more about how we can align and support.

About the Author

Pankaj Tanwar is Managing Director of Climate Services at CarbonBetter. He has experience leading Fortune 100 companies through their sustainability journeys, including sustainability driven growth in the food industry. Pankaj holds an MBA from Northwestern University’s Kellogg School of Management and a BTech in Mechanical Engineering from the Indian Institute of Technology, Kanpur.

Ready to get started on your sustainability journey? Contact us.