Sustainability From the Start Webinar Recap

As climate-related disclosure and mitigation requirements continue to evolve, understanding the latest regulatory landscape is essential for US companies. In this webinar, we cut through the jargon to provide clear insights into emerging climate-related requirements, breaking down two key federal proposals and one EU regulation impacting some US-based companies. Join us to stay informed and prepared for what’s ahead in climate compliance.

SUSTAINABILITY REPORTING OVERVIEW

Sustainability reporting serves as a valuable tool to achieve corporate commitments and better manage climate-related business risks. This white paper walks you through what’s typically included and what should be considered.

Key insights from our recent webinar on the journey to achieving net-zero emissions and the importance of sustainability in modern business.

Our most recent webinar, “Sustainability From the Start: Your Guide to Net Zero by 2040,” offered an in-depth exploration of the path to net-zero emissions and the evolving landscape of sustainability in business. In partnership with Greentown Labs, the webinar was moderated by Dominic Sung, our Director of Business Development, with Nicole Sullivan, former Director of Climate Services, and Tori Chen, former Climate Analyst, joining the discussion. The discussion spanned a variety of crucial topics, from understanding the true meaning of “net zero” to the expanding regulatory landscape and the tangible ROI of sustainability. The session concluded with some practical steps businesses can take today to progress toward their sustainability goals and the role of carbon offsets in a comprehensive decarbonization strategy. In this post, we’ll provide a recap of the key takeaways.

Watch the full video replay.

Introductions

The webinar kicked off with introductions from the panelists. They highlighted their backgrounds and expertise in the sustainability sector, setting the stage for the in-depth discussions that followed. The importance of the topic was emphasized, given the increasing global focus on sustainability and the need for businesses to adapt.

The difference between pledging net zero and achieving it

The panelists explained the nuances between merely pledging to be net-zero and actually achieving it. They discussed the challenges many companies face in their journey towards sustainability, emphasizing that while making a pledge is a commendable first step, the real work lies in implementing actionable strategies to achieve these goals. The importance of transparency and accountability in this process was also highlighted.

What does it mean to be net zero?

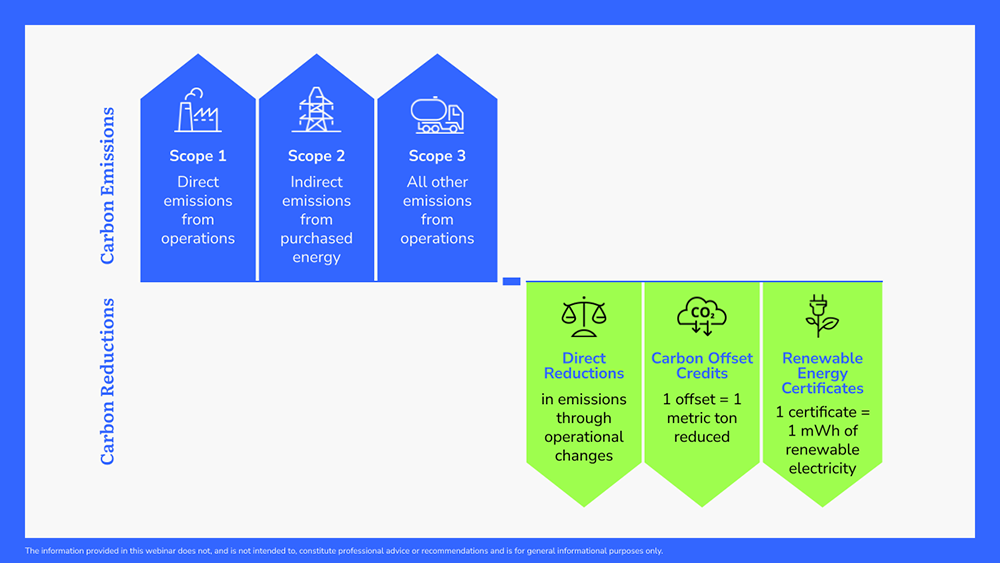

This segment provided clarity on the term “net zero.” The panelists explained that being net zero means balancing the amount of greenhouse gasses (GHG) emitted with the amount removed from the atmosphere. They discussed the various strategies businesses can adopt to achieve this balance, such as reducing emissions, investing in renewable energy, and offsetting emissions through initiatives like tree planting.

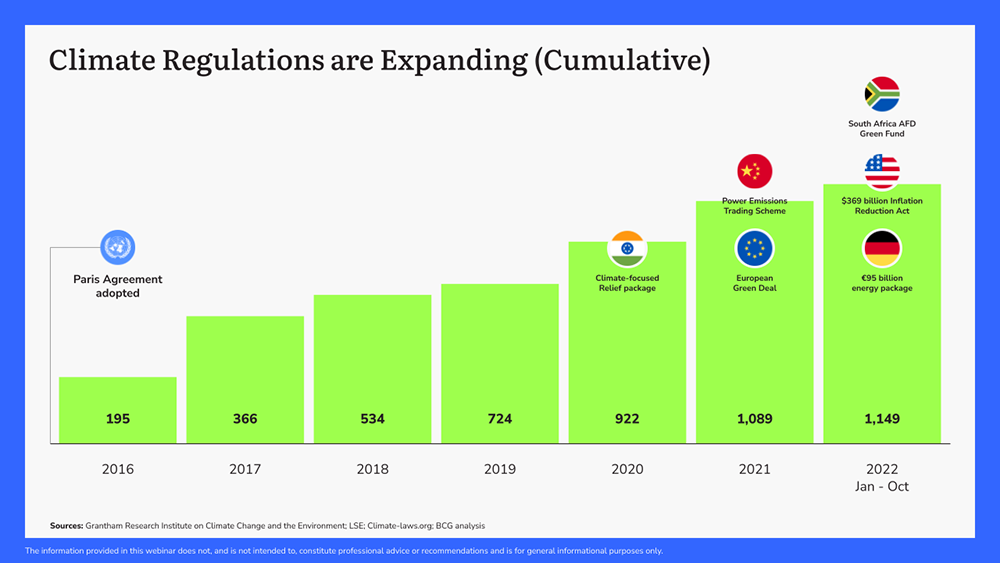

The expanding regulatory landscape

The discussion shifted to the evolving regulatory landscape surrounding sustainability. The panelists highlighted upcoming regulations and standards that businesses need to be aware of, including the proposed SEC Climate Disclosure rule, the federal supplier proposed rule, and the European Union’s (EU) Corporate Sustainability Reporting Directive (CSRD). They emphasized the importance of staying updated with these changes to ensure compliance and avoid potential legal and financial repercussions. Examples of regulatory pressures, such as the forthcoming global plastics treaty and state-by-state extended producer responsibility (EPR) schemes in the US, were cited.

The sustainability reporting ecosystem

The panelists discussed the growing ecosystem of sustainability reporting. They touched upon the various frameworks, standards, and tools available for businesses to report their sustainability efforts. The importance of choosing the right framework that aligns with a company’s goals and stakeholders’ expectations was emphasized. The challenges brands face in implementing sustainability initiatives, such as meeting consumer demands, quality standards, and regulatory compliance, were also discussed.

Audience poll: Have you set a net-zero target?

During this segment, the audience was engaged in a poll to gauge how many participants have already set a net-zero target for their respective organizations. The results of the poll were insightful, revealing a mix of companies at various stages of their sustainability journey. The panelists used this data to tailor their subsequent discussions, addressing the needs and concerns of both companies that have set targets and those still considering it.

Is sustainability becoming more important to stakeholders?

The panelists discussed the rising importance of sustainability to stakeholders, from investors to consumers. They highlighted recent trends showing increased demand for sustainable products and practices. The discussion also touched upon the role of stakeholders in driving companies toward more sustainable operations. Real-world examples were shared, showcasing how businesses have benefited from aligning their strategies with stakeholder expectations on sustainability.

The importance of incorporating sustainability into your business from the start

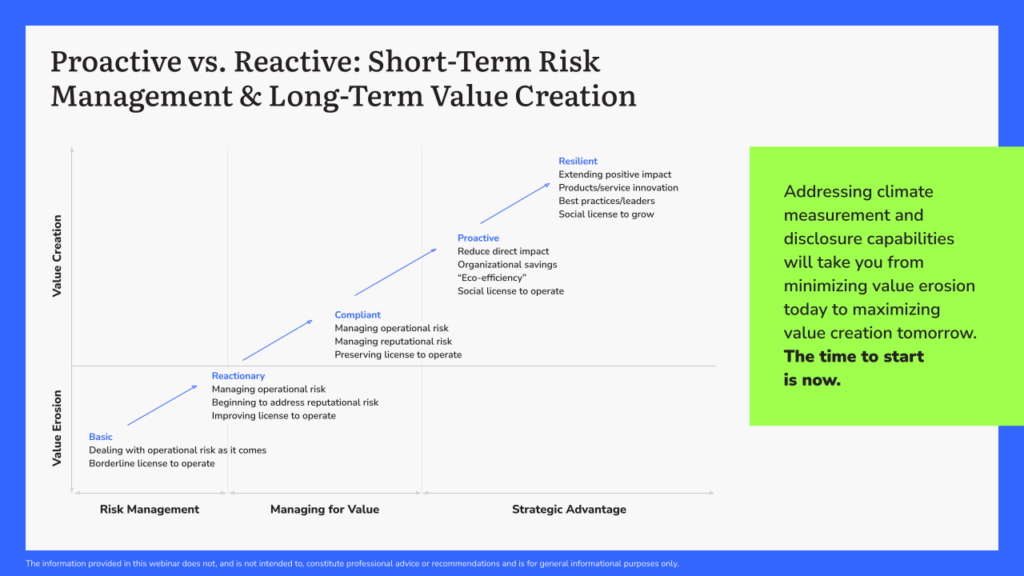

Emphasizing the significance of early adoption, the panelists discussed the advantages of integrating sustainability from the inception of a business. They pointed out that companies that embed sustainability into their core strategies often find it easier to adapt to regulatory changes, meet stakeholder expectations, and achieve long-term success. The discussion also touched upon the challenges and potential pitfalls of retrofitting sustainability into established operations.

The ROI of sustainability

The return on investment (ROI) of sustainability was a key topic of discussion. The panelists talked about the tangible and intangible benefits companies can reap from sustainable practices. They highlighted how sustainability can lead to cost savings, enhanced brand reputation, and increased customer loyalty. Real-world examples were provided, showcasing companies that have seen significant ROI from their sustainability initiatives.

Steps to take before making a sustainability claim or commitment

The panelists provided guidance on the crucial steps companies should take before publicly announcing sustainability claims or commitments. They emphasized the importance of thorough research, stakeholder engagement, and ensuring that any claims can be substantiated. The risks of greenwashing were also discussed, with the panelists advising companies to be transparent and honest in their sustainability communications.

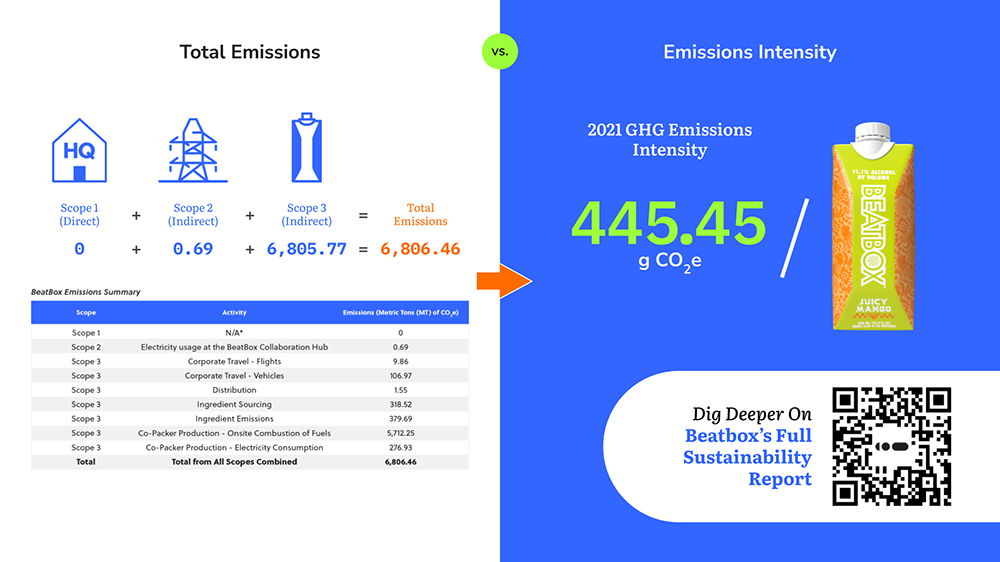

How do you reduce emissions while simultaneously expanding operations?

The panelists discussed the delicate balance between business growth and sustainability, and the importance of tracking metrics such as carbon emissions intensity. They highlighted strategies that allow companies to expand their operations while still reducing their carbon footprint. Emphasis was placed on the importance of innovation, adopting cleaner technologies, and streamlining operations to be more energy-efficient. The discussion also touched upon the role of renewable energy sources and the potential of carbon capture and storage (CCS) technologies.

How do you make progress toward your sustainability goals today?

The conversation shifted to actionable steps businesses can take in the present to progress towards their sustainability goals. The panelists emphasized the importance of setting clear, measurable targets and regularly monitoring progress. They also discussed the role of employee engagement, stakeholder collaboration, and the need for continuous learning and adaptation in the face of evolving sustainability challenges.

Carbon offsets as part of your decarbonization strategy

Carbon offsets were highlighted as a viable strategy for companies aiming to neutralize their carbon emissions. The panelists discussed the various types of carbon offset projects available, such as reforestation and renewable energy projects. They also touched upon the importance of ensuring the credibility and effectiveness of these projects, emphasizing the need for third-party verification.

Where and how to buy high-quality carbon credits

The discussion then shifted to the purchasing carbon credits. The panelists provided insights into identifying high-quality credits, emphasizing the importance of transparency, traceability, and third-party verification. They also discussed potential pitfalls and challenges in the carbon credit market and provided guidance on navigating these challenges.

The risks associated with sustainability inaction

The panelists highlighted the various risks companies face by not taking proactive steps towards sustainability. These risks range from regulatory penalties and legal challenges to reputational damage and loss of consumer trust. The discussion also touched upon the potential financial implications, with companies potentially missing out on investment opportunities or facing divestment.

The biggest hurdles and opportunities for companies setting and reaching their targets

This segment focused on the challenges and opportunities companies face in their sustainability journey. The panelists discussed common hurdles, such as lack of knowledge, resources, or stakeholder buy-in. They also highlighted the opportunities that arise from embracing sustainability, including access to new markets, increased consumer loyalty, and potential cost savings.

Request a free Office Hours session with Nicole

A QR code was shared, offering attendees a chance to schedule a free office hours session with Nicole to address any sustainability questions they might have. This segment emphasized CarbonBetter’s commitment to supporting businesses in their sustainability journey and providing personalized guidance.

QR codes for Nicole’s, Tori’s, and Dominic’s LinkedIn

Attendees were provided with QR codes to connect with Nicole on Linkedin, Tori on Linkedin, and Dominic on LinkedIn.

Is CarbonBetter working on any projects in Africa?

The panelists discussed CarbonBetter’s ongoing and potential projects in Africa. They highlighted the continent’s unique sustainability challenges and opportunities and emphasized the company’s commitment to supporting sustainable development in the region.

Is CarbonBetter open to partnering with small sustainability consultants who are helping their clients achieve their operational and sustainability goals?

The webinar concluded with a discussion on collaboration opportunities. The panelists expressed CarbonBetter’s openness to partnering with small sustainability consultants, emphasizing the value of diverse perspectives and expertise in driving sustainable change.

Conclusion

The journey to sustainability and achieving net-zero emissions is multifaceted, but with the right guidance, it’s entirely within reach. Whether you’re at the beginning of your sustainability journey, aiming to understand the nuances of carbon offsets, or looking to set ambitious net-zero targets for your organization, our team of experts is here to assist. With a deep understanding of the sustainability landscape and the challenges and opportunities it presents, we’re ready to help your business make a meaningful impact. Contact us today to get started on your sustainability journey.

At CarbonBetter, we believe in progress over perfection. It’s not about doing everything—it’s about doing something. With over a decade of experience in the energy industry, we partner with organizations to guide them in the transition to a net-zero economy. CarbonBetter’s sustainability specialists work closely with partners across all industries to integrate sustainability solutions seamlessly into any business.

CarbonBetter helps organizations of all sizes measure, reduce, report, and offset their emissions, and tell stories about their sustainability journey.

Telling stories about sustainability efforts helps other organizations take action that will then, in turn, inspire others—it’s never too early or late to start.