Sustainability Risk Management: Stay Ahead of the Curve

SUSTAINABILITY REPORTING OVERVIEW

Sustainability reporting serves as a valuable tool to achieve corporate commitments and better manage climate-related business risks. This white paper walks you through what’s typically included and what should be considered.

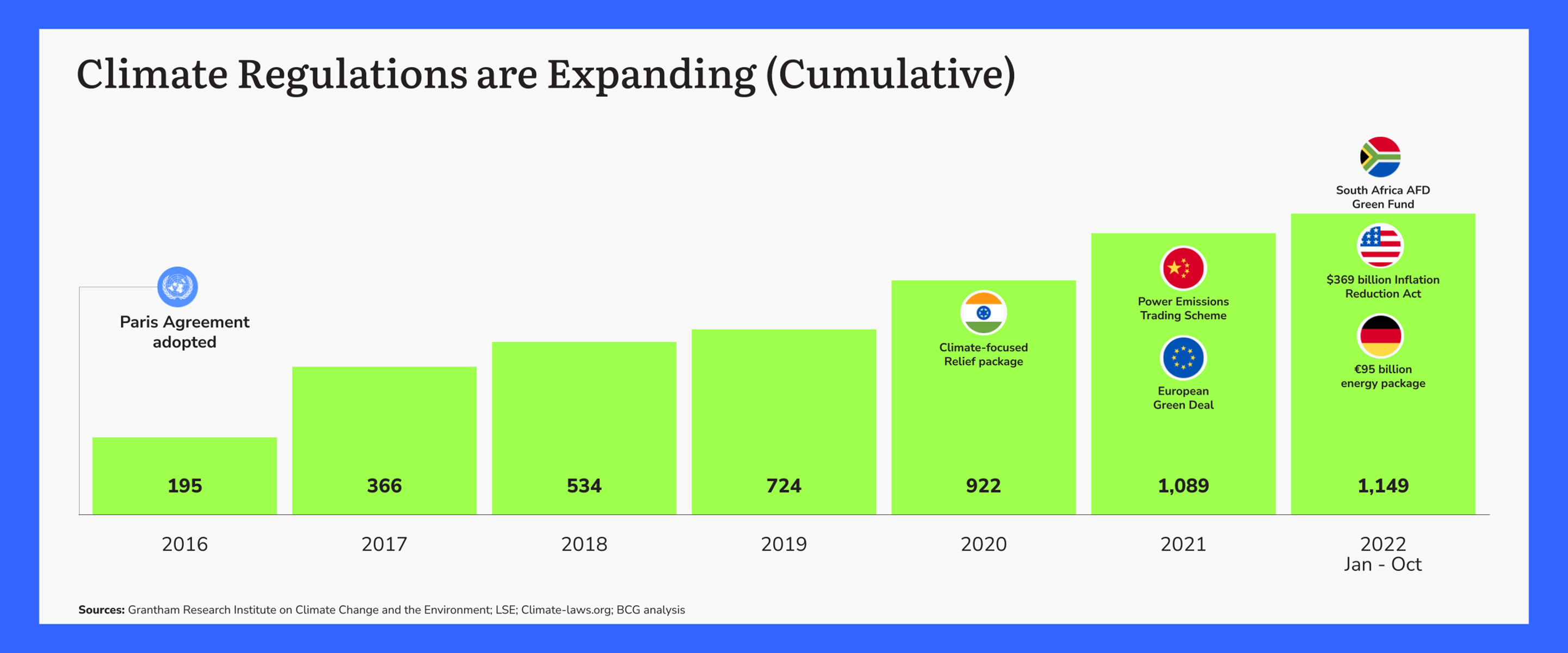

Why a proactive approach to sustainability matters to build operational resilience in the face of evolving regulations and stakeholder interest.

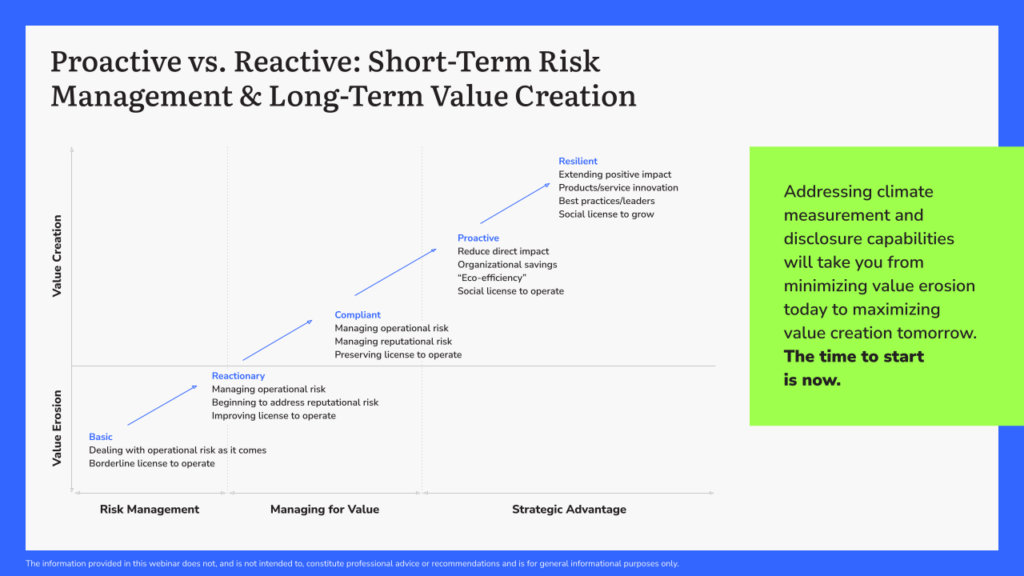

Climate risk is financial risk. With a business landscape more volatile and uncertain than ever, risk management is an essential, often too invisible resource for so many companies. The sooner that businesses can address climate measurement and disclosure head-on, the more competitive and prepared they can be in navigating future regulatory, commercial, and reputational risks. In this blog post, we will explore the journey from basic, reactive risk management to a more resilient, proactive approach: one that minimizes value erosion while maximizing long-term value creation. We’ll also discuss the differences between proactive and reactive approaches to risk management, and the benefits of applying a formalized system to carbon emissions.

The journey from reactive to proactive with climate risk management

1. Basic: Dealing with Operational Risk as It Comes

This approach has the potential to be the costliest and most painful approach. If you find yourself here, your organization has chosen to deal with operational challenges only as they arise and is likely often in firefighting mode, constantly navigating red tape. This inevitably leaves your organization vulnerable to unforeseen events and disruptions, while obscuring the bigger picture of potential opportunities.

For instance, failure to comply with the proposed upcoming Federal Supplier Rule could put your federal contracts into jeopardy. If you’ve taken on a reactive approach, what do you have to put on hold in order to scramble to get compliant in a short timeframe? What data will you need that you currently don’t have on hand?

The good news is that there are measures that you can implement to establish a more proactive mindset. Much of that starts with understanding the upcoming regulatory roadmap and conducting a gap assessment to understand which regulations your business may be subject to, and what datasets, technical resources, and budget you’ll need to comply.

2. Reactionary: Managing Operational and Reputational Risk

Like the basic approach, the reactionary mindset still carries a high potential for operational and reputational risk. Unlike the basic approach, it signals a shift in at least acknowledging reputational risk and the need to improve your “license to operate.”

Without a clear strategy to plan for new regulations, the reactive approach can still catch companies off-guard by new regulations or changes in the business environment, resulting in potential non-compliance and non-conformance to regulations and industry standards. This can result in penalties, fines, or reputational damage that can be difficult, costly, and time-consuming to undo.

Take the Swedish oat milk brand, Oatly, for instance. In 2022, the company came under fire for its marketing campaign in 2022, which stated that “climate experts say cutting dairy and meat products from our diets is the single biggest lifestyle change we can make to reduce our environmental impact,” and a paid social ad that read: “Dairy and meat industries emit more carbon dioxide (C02) than all the world’s planes, trains, cars, boats, etc, combined.” Oatly’s ads were banned as a result of the misleading environmental claim, and its reputation was dented.

Whether creating marketing messaging, building in-house expertise to prepare for an upcoming sustainability disclosure, developing a new product, or navigating the carbon credit market, it is critical to consider regulations, guidelines, and industry best practices early on to avoid last-minute delays or greenwashing allegations.

3. Compliant: Preserving License to Operate

Next on the journey, the primary goal of the compliant approach is to preserve the license to operate, and in doing so, manage both operational and reputational risk. This is a stepping stone toward resilience, but treating existing regulations like a tick-the-box exercise is a limitation in itself.

There are plenty of risks connected to failing to comply with new and emerging regulations, and many of them are inconspicuous. Many investors are now actively looking for evidence that a company has a robust system in place to quantify and disclose its carbon emissions year-on-year, as well as a deep understanding of the sustainability regulatory landscape.

A lack of a robust measurement and reporting system might mean anything from scoring lower on the Carbon Disclosure Project (CDP) and losing category leadership, or even seeing a higher cost of capital in investment rounds. Companies unable to demonstrate an understanding of their climate risk may be deemed as higher risk and therefore less competitive.

“By being proactive, you’ve set a strategic course to know you’re steadily working towards compliance well ahead of actual enforcement and thoughtfully mitigating your risk. You’re on the leading edge of things and able to innovatively think about not just the risks for your business, but opportunities that lie ahead as well.”

DOMINIC SUNG, former DIRECTOR OF BUSINESS DEVELOPMENT AT CARBONBETTER

FW Sustainability Report

Learn more about how Fierce Whiskers has made sustainable choices every step of the way by downloading its full sustainability report.

Skip the RFP—CarbonBetter can help

CarbonBetter Certified Offset Portfolios allow carbon buyers to participate in a variety of projects, geographies, and technologies in one simple transaction rather than navigating a lengthy and complex RFP process with multiple carbon market participants.

Learn More about CBCO 22-14. Proactive: Reducing Direct Impact and Achieving Organizational Savings

Businesses that take a proactive approach to sustainability and risk management give themselves a greater ability to focus on long-term success. That means building a deep understanding of the future regulatory roadmap, looking towards European and international sustainability reporting standards for signs of upcoming disclosure requirements, and ensuring that your internal ESG data systems are correctly set up to handle them.

It’s also where the concept of “eco-efficiency” comes in, and its role in achieving a social license to operate.

Eco-efficiency was first coined by the World Business Council for Sustainable Development (WBCSD) in its 1992 publication “Changing Course”, and at the 1992 Earth Summit, endorsed as a transformative business concept. In short, its philosophy combines management with sustainability, ecology, and economic efficiency: creating more goods and services while using fewer resources and reducing carbon emissions.

5. Resilient: Extending Positive Impact and Innovating Products or Services

Resilience is the culmination of all of the above steps, where your business leads the way in the world of environmental risk management. Removing as much of the reactive work as possible creates space to uncover new opportunities to stay ahead of the competition and become an industry leader. That innovation is precisely the step towards growth and category leadership.

With a group of stakeholders – from your investors, customers, and communities – behind you, consistent risk management becomes a sign of trust that in turn, provides a social license to grow.

Risk management planning checklist

Strategy and risk management are inherently connected. If "risk is a function of how poorly a strategy will perform if the 'wrong' scenario occurs” (Porter, 1985), then having a clear roadmap and vision is fundamental to driving tangible value.

To take your approach to environmental risk management from reactive to proactive, there are a number of resources that are often the difference between a successful strategy and one that fails to gain traction quickly enough.

While you start to create your risk management strategy from a sustainability perspective, here are some critical questions to ask:

- Have you quantified your carbon footprint?

- Do you have a formalized carbon management strategy in place?

- To what extent is your leadership team engaged?

- How does senior management perceive competitor pressures?

- Do internal and/ or auditors have oversight over carbon mitigation plans?

- Do you have adequate resources and budget allocated to the project?

Conclusion

Transitioning from reactive risk management to a proactive and resilient approach is a journey and takes time. By preparing early and working with experts to shape your strategy, businesses can mitigate risks, achieve organizational savings, and innovate products and services around new markets and pain points.

At CarbonBetter, we're here to support and guide businesses throughout their sustainability journey to maximize value creation. To learn more about the upcoming US regulations, watch the webinar recap here. To learn more about a gap assessment for your business, contact us today to get started.

Reactive risk management involves addressing challenges and disruptions as they manifest, often leading to unforeseen consequences and missed opportunities. Proactive risk management, conversely, is about anticipating potential risks, preparing for them, and strategically positioning the business to leverage these challenges into opportunities for long-term value creation. It's the difference between being constantly on the defensive versus strategically planning for the future.

The transition begins with a comprehensive understanding of the upcoming regulatory landscape. This means staying informed about potential changes, conducting thorough gap assessments to identify areas of vulnerability, and ensuring that the organization has access to the necessary datasets, technical resources, and budget. Additionally, fostering a culture of forward-thinking and sustainability within the organization can drive proactive behaviors at all levels.

Non-compliance can have a multi-faceted impact. Immediate consequences might include penalties, fines, and legal actions. However, the long-term repercussions can be even more damaging: reputational harm, loss of trust among stakeholders, reduced competitive advantage, and potentially higher costs during investment rounds. In today's world, where transparency is paramount, non-compliance can significantly tarnish a company's image and stakeholder relations.

A proactive approach positions businesses to anticipate and prepare for future regulatory and environmental changes. This not only safeguards against potential disruptions but also allows businesses to identify and capitalize on new opportunities, be it in product innovation, market expansion, or stakeholder engagement. Furthermore, it demonstrates to investors and customers a commitment to sustainability, which can enhance brand value and trust.

A robust environmental risk management strategy is built on several pillars. Firstly, a clear and quantifiable understanding of the company's carbon footprint provides a baseline. Next, a formalized carbon management strategy, aligned with the company's broader objectives, is essential. Engaged and informed leadership is crucial, as their buy-in can drive organizational alignment. Understanding competitor pressures and industry benchmarks can provide context. Lastly, ensuring that there are dedicated resources, both in terms of personnel and budget, and that there's oversight over carbon mitigation plans, is key to effective execution.