Webinar Recap: New US Climate Regulations—Are You Ready?

As climate-related disclosure and mitigation requirements continue to evolve, understanding the latest regulatory landscape is essential for US companies. In this webinar, we cut through the jargon to provide clear insights into emerging climate-related requirements, breaking down two key federal proposals and one EU regulation impacting some US-based companies. Join us to stay informed and prepared for what’s ahead in climate compliance.

Highlights from our webinar about upcoming US regulations and what you can do to start preparing your organization.

Earlier this week, Dominic Sung, former Director of Business Development, and Nicole Sullivan, former Director of Climate Services, discussed upcoming and proposed climate-related disclosure and mitigation requirements that will affect United States (US) businesses. Rules and regulations discussed include the upcoming SEC climate disclosure rule, the Federal Supplier Climate Risks and Resilience Proposed Rule, as well as the Corporate Sustainability Reporting Directive (CSRD), a European Union (EU) law that will affect some US businesses in the next few years. This recap post will include some highlights from the conversation, but don’t miss the full replay for more insights.

WATCH THE WEBINAR REPLAY

Missed the live webinar? Watch the reply anytime to make sure your organization is prepared for upcoming and proposed regulations that will affect US businesses.

WATCH NOWA Brief Look at the Global Regulatory Framework

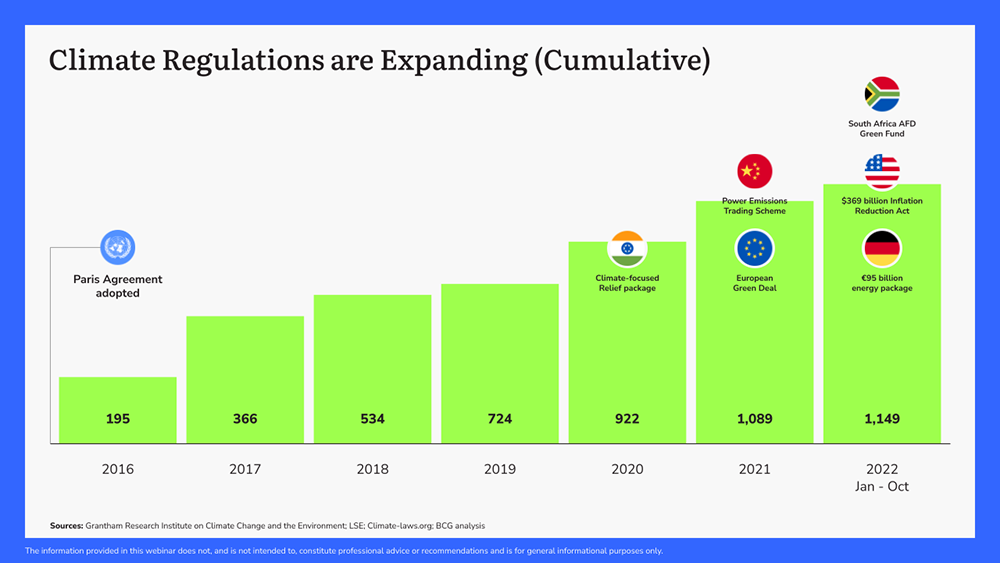

Nicole provides a brief look at the global regulatory framework for climate regulations, including the sharp increase of regulations across the globe.

Nicole: Before we dive into a select few proposed and active regulations today, I want to start by looking at the global regulatory framework for climate regulations. This chart here was put together by Boston Consulting Group in partnership with the World Economic Forum. Since the Paris Agreement was adopted in December of 2015, we have seen a sharp increase of climate regulations globally. Just last year from the period between January to October, we saw more than 1,100 new climate regulations. So in reality, even if the regulations we discussed today that are currently in a proposed state don’t hit, it’s likely not a matter of if there will be climate regulations but when, as we are seeing an upward trend in the number of regulations globally.

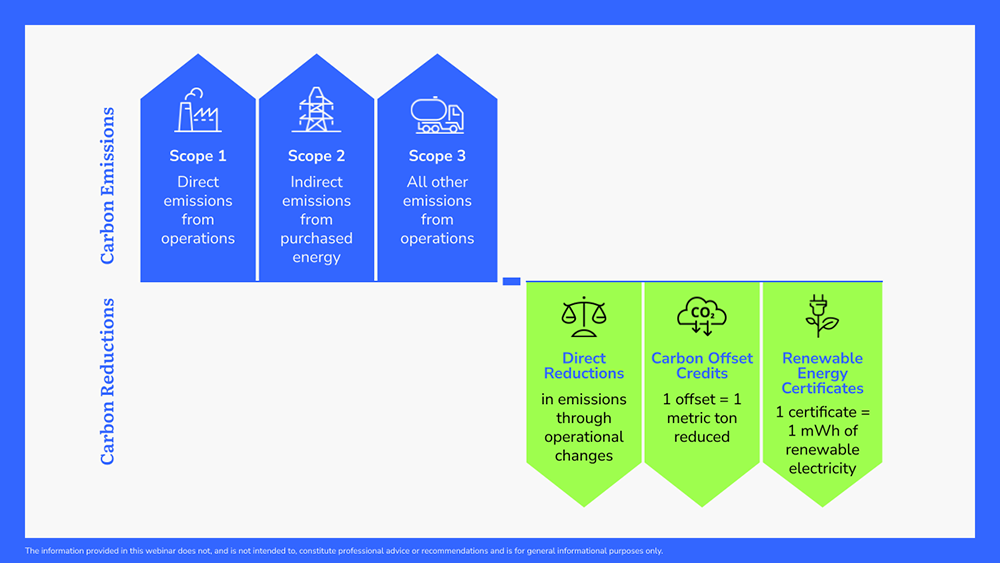

To give some context to some of the concepts that the rules we’re talking about today will require, I first want to give just a really quick primer on carbon emissions. You’ll sometimes hear that referred to as carbon accounting, greenhouse gas (GHG) emissions quantification, as well as carbon footprinting. But GHG gas emissions are typically broken into three different scopes. You have your Scope 1 emissions, which are your direct emissions from operating and fuel combustion. This would include things like natural gas furnaces and fleet vehicles. Then you have Scope 2 emissions, which are your indirect emissions from purchased energy. So if you consume electricity at your facility, there are still emissions associated with the grid and the power plant generating that power that you consume. Those fall under Scope 2. Scope 3 is everything else, and this can be the most complicated emission source to quantify, because your Scope 3 emissions include your supply chain as well as all other emission sources from operations, such as corporate travel.

And then on the other side of this chart here you see reductions. Carbon reductions are sometimes referred to as decarbonization, and these include things like direct reductions. These would be operational changes or equipment swap outs as well as indirect reductions, such as carbon credits where one carbon credit or offset equals one metric ton of carbon dioxide equivalent reduced (CO2e). And then we also have renewable energy certificates (RECs) which can be used to offset your electricity consumption.

So if your emissions minus your reductions equals zero, that’s what we commonly refer to as net-zero. But I just wanted to tee up those concepts as well as introduce a few of the disclosures and reporting frameworks out there as well as a target setting framework that we’ll be talking about today. Some common disclosure frameworks that you see are the CDP, which is formally referred to as the Climate Disclosure Project, as well as the task force on climate-related financial disclosures. The Sustainability Accounting Standards Board, or SASB, and then a common protocol utilized to quantify GHG emissions is the GHG protocol. Now this list isn’t comprehensive of all the frameworks and protocols out there today but these are some of the ones relevant to the rules we’ll be discussing.

And then you can set targets to reduce your emissions, reduce your water usage, anything environmental related and KPI related you can set targets for. But there is a process through which you can set science-based targets through the Science-Based Targets Initiative or SBTi and to set science-based targets that are aligned with rapidly reducing GHG emissions to limit warming to 1.5 degrees Celsius (C), under the SBTi protocols you actually have to submit your targets to the SBTi for approval. So some of the rules we’ll talk about today actually do reference SBTi. Alright, so I’ve thrown a lot at you, but there’s also way more you could take a deep dive on as it relates to disclosures and different frameworks.

So we actually wrote a white paper on this topic late last year, and you can download it with this link here. This is an overview of all things sustainability reporting and does have a helpful summary of some of the broader frameworks out there beyond the ones we’ll be covering today.

An Overview of the Upcoming US Climate Regulations

Nicole and Dominic discuss new and upcoming climate regulations that will affect US businesses.

Nicole: Alright, so now with that context I’d like to highlight the three rules that this session will be focused on. So we’re going to take a look at the proposed SEC climate disclosure rule which would affect public companies in the US. We’ll look at the proposed federal supplier climate disclosure rule impacting federal suppliers in the US. (Note: both of these are in a proposed state. They are not officially rules that you have to comply with yet but they are proposed and they could become effective either as written or as in a revised state.) And then there’s also a European Union reg called the Corporate Sustainability Reporting Directive, or the CSRD. That rule is officially a rule already, and it will have impacts on some US companies. So these are the three we’re taking a deep dive on today.

You might have other climate-related disclosure rules applicable to you, and while we are seeking to give an overview of the rules today, please note this is not professional advice for compliance on these rules, nor is it legal advice. This is just our way of sharing with you what we feel is really important information and timely information. So with that, I’m going to hand it over to Dominic to unpack the proposed SEC climate disclosure rule.

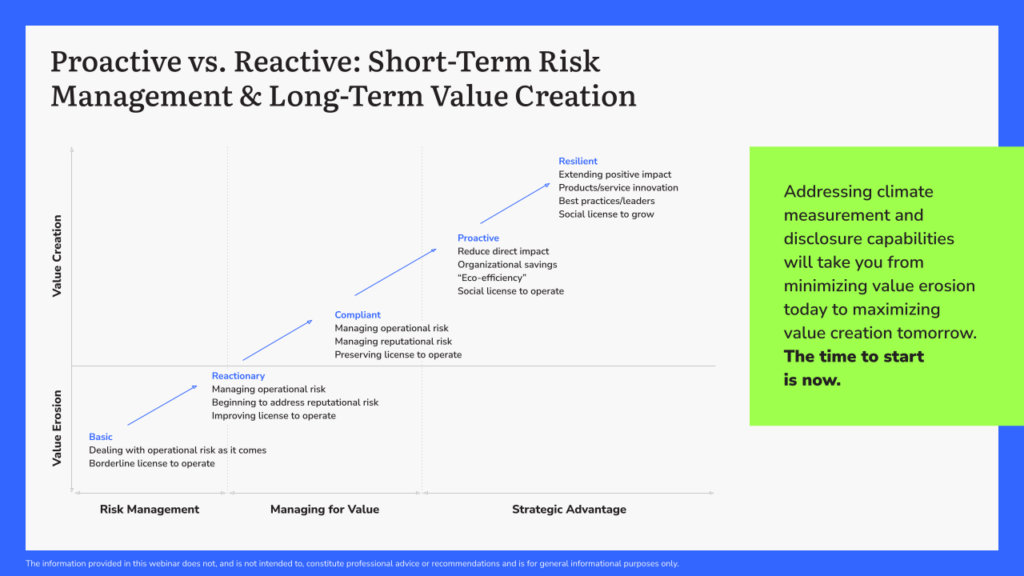

Dominic: Yeah, really you should start today. What’s being stated is really clear that climate risk is financial risk, and the sooner that you as a company can be proactive and mitigate these risks and can take advantage of the opportunities, the more able to be competitive your company can be. Again, regulations are coming, it’s less a question of if, but when, and there’s additional value to doing this voluntarily.

So if we look at being proactive versus reactive, and we think about this as a continuum from being basic and reactionary on one end, up to being proactive and being a thought leader on the other end: On one end, you’re just towing the line closely and reactively trying to respond as challenges come, and this puts you in a position with higher risk potential and higher frequency for non-compliance and non-conformance. On the other end, by being proactive, you’ve set a strategic course to know you’re steadily working towards compliance well ahead of actual enforcements and thoughtfully mitigating your risks. You’re on the leading edge of things and able to innovatively think about not just the risks for your business, but opportunities that lie ahead as well.

And so with that I’d really like to talk about some of the risks of inaction and not being proactive, inaction particularly in the case that more than one of these rules is applicable to your company, which can be risky, painful, and potentially very costly. There’s a loss of investment both institutional and individual and potentially the higher cost of capital associated with that. There’s potentially federal contract loss in revenue from that. In the case of the federal supplier rule, you may be jeopardizing the contract if you’re non-compliant. There’s potential loss of license to operate, potential falling behind your competitors, if particularly comparatively your CDP scores, for instance, are higher for your federal supplier competitors potentially.

And then the business intervention that may be caused to address compliance in a short timeline. If you’re reactive, what do you have to put on hold in order to scramble to get compliant in a short timeframe? And then potentially the stress on your budgets and resources. What resources and budgets do you have to get if you did not strategically plan for what it takes to be compliant? What data will you need that you don’t currently have on hand? I mean, a lot of this is managing risk and you can’t manage what you haven’t measured.

“We at Carbon Better have actually done the legwork on this for these proposed rules. So if you need help with your gap assessment, definitely don’t hesitate to reach out to us.”

NIcole Sullivan, former Director of Climate Services at CarbonBetter

SUSTAINABILITY REPORTING OVERVIEW

Sustainability reporting serves as a valuable tool to achieve corporate commitments and better manage climate-related business risks. This white paper walks you through what's typically included and what should be considered.

Preparing Your Organization for Upcoming Climate Rules

Nicole discusses steps you can take to start preparing your business ahead of upcoming and proposed climated-related rules and disclosures that will affect US businesses, so that you can avoid any potential fines due to non-compliance.

Nicole: Awesome, thank you, Dominic. So now that you know more about these proposed and existing rules as well as why you should start preparing today, I actually want to dig into how you can start preparing today. One of the most important steps to figuring out your pathway towards compliance with an emerging or new regulation is to really understand where your business is at today in comparison to the requirements of the rule. So I always advise clients to do a gap assessment to figure out what the rule requires and what they're doing already that might help them towards their path towards compliance or where the gaps are. What do they need to do to be able to close those so that they can ultimately confirm compliance when the rule becomes effective or there is a compliance state in place?

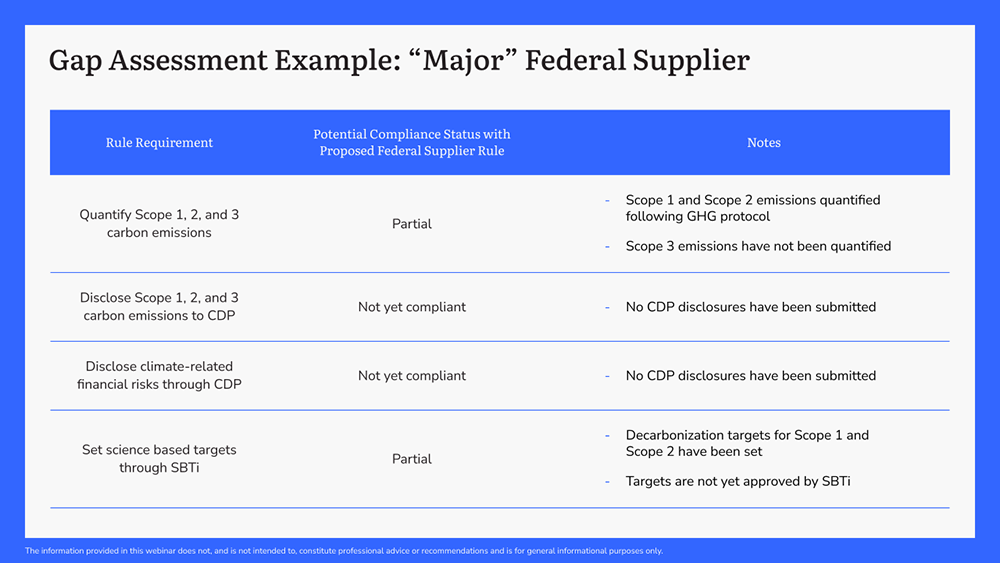

So I actually want to walk you through an example gap assessment for a major federal supplier today. And as you can see on the left hand side, we have the rule requirement. So before you can even do a full gap assessment, it's really important to actually break down the rule into the actionable tasks that your company would potentially be required to complete. And breaking those actions down in layman's terms, into the tangible action that you would have to do can be really beneficial. We at Carbon Better have actually done the legwork on this for these proposed rules. So if you need help with your gap assessment, definitely don't hesitate to reach out to us.

But in this example, for the major federal supplier, which if you recall they would be required to do Scope 1, 2, and 3 emissions quantification as well as disclosure of those emissions and their climate-related financial risks to the CDP. And then there's also an SBTi target setting requirement. So once you know the actions that the rule would require you to do, here's where you then scrutinize what your operations look like today in comparison to those requirements.

And from there you can assess, are you already doing this? If so, you can continue on business as usual to meet these requirements. Are you part of the way there and you've taken some actions, but you need to build upon those to be fully compliant when the rule hits? Or are you not even started yet, or just not there? So in the case of this example, which is some nebulous company that doesn't exist, for quantifying their emissions for Scopes 1, 2, and 3, they're partially there. They've quantified Scopes 1 and 2.

So to bridge the gap of the rule, they will have to quantify their Scope 3 emissions. So they'll need to start planning for resources to gather all of that data, build out those calculations and be able to do their Scope 3 emissions ahead of their disclosure requirement. In terms of disclosing emissions and climate-related risks to the CDP, they haven't yet done that, so they're going to need to figure out a pathway to answering the CDP questionnaires and getting those submitted.

And then lastly, with respect to setting SBTi targets, this example is partially there. They have set targets to decarbonize for their Scope 1 and 2 emissions but they have not submitted those for acceptance by SBTi. So now that you've seen an example of what a gap assessment might look like, how do you actually close the gaps?

This requires planning and lead time to be able to get from where you are today to where the rule or rules might require in the case of multiple regulatory obligations. So one of the first things that's important to look at is your resourcing. Do you have the staff that you need and or the third party support in place to be able to confirm compliance with these proposed rules? This might require hiring. This might require contracting with a third party as noted by Dominic for the CSRD rule.

In the EU, that rule actually does require third party verification. But even in the absence of third party verification requirements in some of the other proposed rules, a third party support resource can be really valuable in helping you to validate your data, give that quality assurance and confirmation that your disclosures are accurate and help you to mitigate risk as you work towards disclosing your climate impacts possibly for the first time.

Then you need to look at budget. So have you actually allocated any budget to sustainability? Do you have the money to spend on these resources that you might need to confirm compliance? If the answer is no, I would encourage you to start planning ahead of your next budget cycle so that you can get line items for compliance with climate disclosure rules into your budget in a timely fashion.

The next thing, and this one is actually, maybe one of the trickiest ones to assess is do you have access to all of the necessary data? So depending on where you're at today with your carbon accounting and depending on what the rule requires, have you lined up the data that you'll need to do your GHG emissions calculations?

And if say you need to calculate your Scope 3 emissions, but you haven't done that before, how are you going to reach out to your suppliers, reach out to everyone in your value chain, align your internal stakeholders as well to actually compile all of the data that you need, as well as starting to build out your calculation workbooks or software solutions. However you're going to quantify those emissions, it all requires a lot of data and business processes to make sure that you can get that data and you're not caught without what you need to be able to quantify your emissions.

And then lastly, I think this one kind of touches on all of these other points from a planning perspective, is that it all takes time and if you need new resources, you might have to train those resources. Or if you're leveraging existing resources, there's training that might be required. There's data needs that are going to take time to actually compile. And then there's also the budgetary planning, which can have a lead time.

So it's really important once a rule becomes effective, or even in its preliminary state, to understand what your timeline to compliance would be and start working backwards from that, so that you can ensure that you're proactively working towards compliance versus being caught in a reactionary state if and when these rules hit.

Watch the Webinar for the Full Conversation

Want to watch the full webinar? Check out the full replay here.

Meet the Speakers

Nicole Sullivan / Former Director of Climate Services

Nicole Sullivan led CarbonBetter's climate practice, helping organizations measure, reduce, offset, and report on environmental impacts, including carbon emissions, water, and waste.

Dominic Sung / Former Director of Business Development

Dominic is the former Director of Business Development at CarbonBetter where he helps businesses pursue sustainability and decarbonization goals.

At CarbonBetter, we believe in progress over perfection. It's not about doing everything—it's about doing something. With over a decade of experience in the energy industry, we partner with organizations to guide them in the transition to a net-zero economy. CarbonBetter's sustainability specialists work closely with partners across all industries to integrate sustainability solutions seamlessly into any business.

CarbonBetter helps organizations of all sizes measure, reduce, report, and offset their emissions, and tell stories about their sustainability journey.

Telling stories about sustainability efforts helps other organizations take action that will then, in turn, inspire others—it's never too early or late to start.