Voluntary Carbon Market Clarity: Making Sense of the Trends Webinar Recap

As climate-related disclosure and mitigation requirements continue to evolve, understanding the latest regulatory landscape is essential for US companies. In this webinar, we cut through the jargon to provide clear insights into emerging climate-related requirements, breaking down two key federal proposals and one EU regulation impacting some US-based companies. Join us to stay informed and prepared for what’s ahead in climate compliance.

SUSTAINABILITY REPORTING OVERVIEW

Sustainability reporting serves as a valuable tool to achieve corporate commitments and better manage climate-related business risks. This white paper walks you through what’s typically included and what should be considered.

Key Takeaways from our recent webinar “Voluntary Carbon Market Clarity: Making Sense of the Trends.”

In our recent webinar titled “Voluntary Carbon Market Clarity: Making Sense of the Trends,” we dove into the depths of the voluntary carbon market (VCM), a crucial yet complex tool in global carbon emission reduction and removal efforts. This webinar was designed for decision-makers grappling with the VCM’s intricacies and provided a detailed overview of the market’s current state, characterized by its volatility and the urgent need for transparency and technical understanding. The webinar was moderated by Tori Chen, a former Climate Analyst at CarbonBetter, who was joined by industry experts including Nicole Sullivan, former Director of Climate Services at CarbonBetter, Dominic Sung, a former Director of Business Development at CarbonBetter, and David Moffat, Managing Director at Inlandsis. Topics included the types and roles of market participants, the evaluation criteria for quality carbon credits, the nuanced debate around removals versus avoidance credits (spoiler alert: both removals and avoidance credits are important!), and strategic considerations for using and purchasing carbon credits. In this post, we’ll provide a recap of the key takeaways.

Watch the full video replay.

Can you break down the roles of some of the most common market participants?

The voluntary carbon market consists of diverse participants. Producers, such as project developers and investors, are critical as they generate credit issuances. Project developers often collaborate with investors or off-takers who invest in projects, as developers generally lack access to debt markets. Consumers, or end-users of credits, play a pivotal role in providing capital access. Traders, who aim for profit without retiring credits, have no direct interest in credit retirement. Intermediaries and advisors like CarbonBetter offer crucial services in this unregulated market by facilitating transactions and providing market transparency. Registries, acting as platforms for tracking ownership and transfer of carbon credits, maintain market validity and transparency. Third-party verifiers independently inspect carbon credit generation projects to ensure they meet standards and protocols, while rating agencies like BeZero, Sylvera, and Calyx Global are beginning to play a significant role by rating projects based on specific criteria.

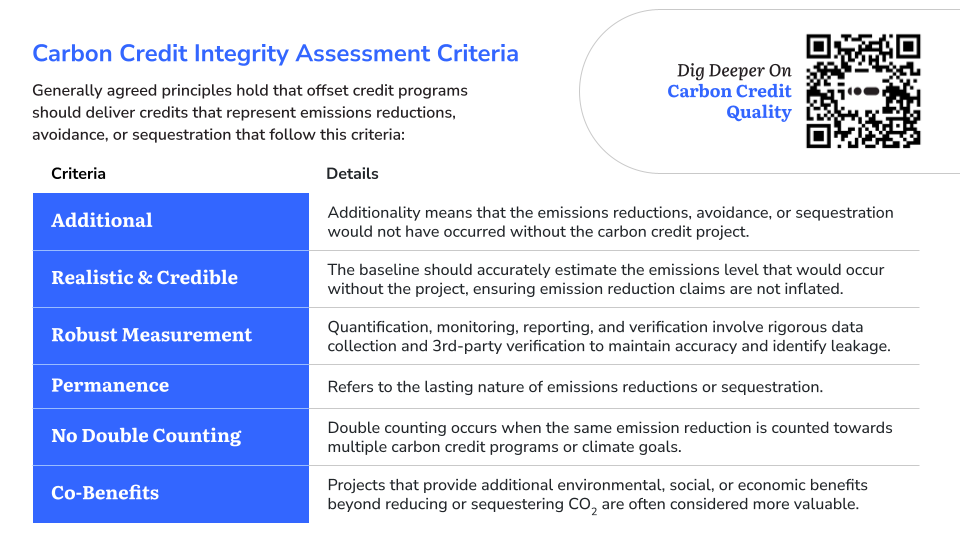

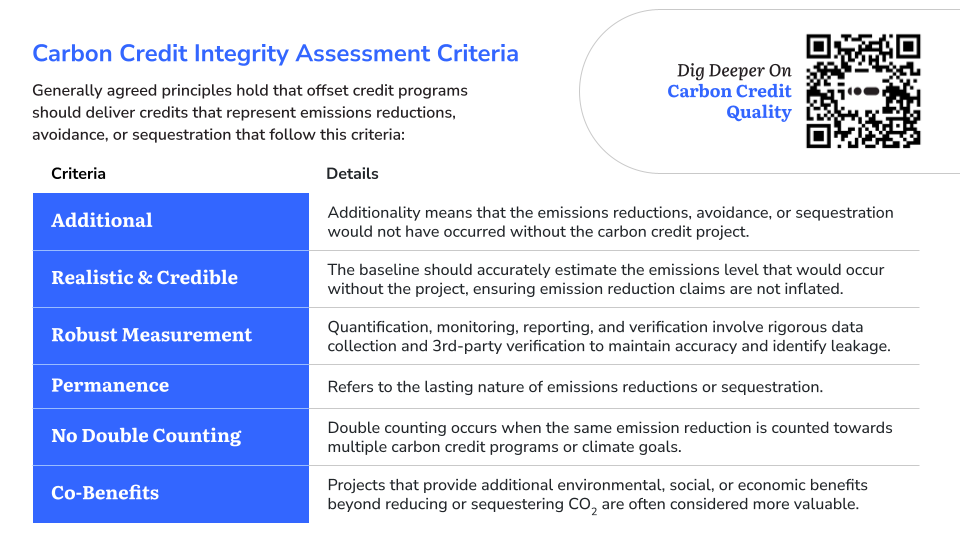

How do you assess a quality carbon credit? (9:36)

Assessing a quality carbon credit involves looking for core quality criteria or integrity criteria. These include whether the project is additional (would not have existed without carbon financing), has realistic and credible math, robust measurement, reporting, and verification (MRV), permanence, and no double counting. It’s also crucial to consider co-benefits like social or environmental impacts beyond carbon reduction. The Integrity Council for the Voluntary Carbon Market (ICVCM) has released Core Carbon Principles (CCPs) to guide this assessment process.

What due diligence processes should businesses consider incorporating to minimize risk when choosing credits?

Businesses should consider several factors related to their organization when choosing credits. This includes understanding how critical these credits are from financial, partnership, and risk perspectives. The capacity to undertake due diligence or engage others to do so is also important. For instance, an investment fund like Inlandsis conducts extensive due diligence before investing in a project, including site visits, interviews with management and suppliers, and analysis across various criteria like project operations, economics, carbon data management, and ESG regulations.

Are there risks or quality concerns when buying credits issued on a new or emerging registry?

With new or emerging registries, it’s important to consider quality. This includes assessing if the registry has third-party verification requirements, a public ledger showing transactions and retirements, and public protocols and methodologies. Due diligence is essential, and businesses should be comfortable with the goals and project technologies issued on the registry. There could be quality concerns, especially if significant documentation isn’t provided and made public by the registry.

With the current focus on removals credits, are avoidance credits still acceptable tools for mitigating emissions?

Avoidance credits are still considered acceptable and necessary tools for mitigating emissions. The market needs all solutions, both avoidance and removals, to reach climate targets. Avoidance credits are vital for funding projects and technologies required to meet these targets.

What is it like to set up nature-based projects and measure their impacts? What are some challenges and obstacles?

Setting up nature-based projects offers benefits like biodiversity protection, water benefits, and community recreation. However, they face challenges in ensuring permanence and accurately quantifying carbon sequestered or avoided. For instance, improved forest management (IFM) projects require statistically robust plots to determine credits generated, which is more challenging than projects where parameters are directly measured and recorded every 15 minutes, as in methane reduction projects.

With the recent increased scrutiny around businesses’ net zero and carbon neutrality claims, can carbon credits still play a role in enabling companies to reach targets and make credible claims?

Despite the increased scrutiny and evolving guidance around claims, carbon credits remain essential for businesses to reach net zero or carbon-neutral targets. It’s currently challenging to achieve these goals without carbon credits due to limitations in technology and the necessity for direct action. Carbon credits enable companies to take climate action while concurrently planning and implementing direct decarbonization strategies. Investing in quality projects and the right carbon credits is crucial, alongside direct action within operations and supply chains. Carbon credits should be used in addition to, not instead of, decarbonization efforts.

What is insetting? How might it work in tandem with offsetting?

Insetting involves direct emission reduction investments within a company’s value chain, complementing offsetting strategies. It’s a valuable and emerging concept in carbon management, particularly for rigorously monitoring and reducing Scope 3 emissions. Insetting requires aligning stakeholders and securing funding, and it can be a longer planning process compared to a spot purchase of carbon credits. It works in tandem with offsetting efforts, allowing businesses to address emissions across their value chain.

What preparation should buyers undergo before approaching sellers?

Buyers should have a clear understanding of their requirements, including the number of credits needed, the budget, and specific project attributes. It’s crucial to know what attributes associated with the credits are important to the organization and its stakeholders. Attributes can include location, whether the focus is on removals or avoidance credits, nature or technology-based credits, and specific project types. Buyers should also understand the risks they are willing to accept and perform due diligence or engage others to conduct it on their behalf. It’s advised to research the seller, review projects listed on their website, and assess if they align with the buyer’s interests and goals. Buyers are encouraged to consider working with intermediaries and advisors for better visibility of market transactions and pricing.

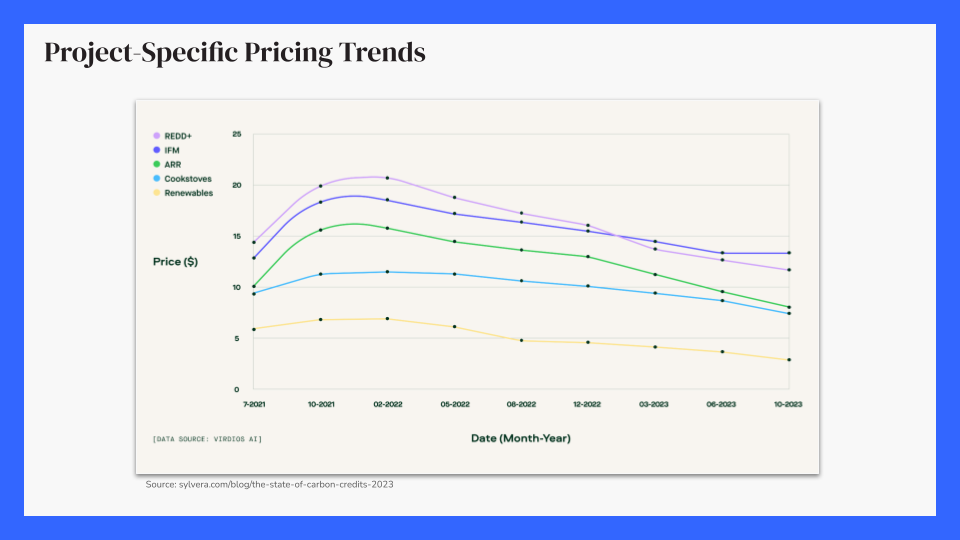

In a market where pricing is down, but also inconsistent across project technologies and credit types, how can buyers assess pricing? With a fixed budget, is it still feasible to get access to meaningful projects?

In the current market environment where pricing is low but inconsistent, it’s still feasible for budget-conscious buyers to access meaningful projects. Partnerships with intermediaries and advisors are recommended for better insight into market transactions and pricing. These intermediaries and advisors have visibility to actual transaction prices, which can be opaque to those not regularly involved in the market. A fixed budget should not preclude access to quality projects, especially given the current lower price levels across all project types. A portfolio approach to offsetting is advised to encompass different geographies and technologies, thereby supporting a variety of carbon reduction projects.

With increased concern about the durability of credits, what can you tell us about developments regarding carbon credit insurance?

The concept of carbon credit insurance is emerging as a solution to durability concerns in the market. It’s still a new area with details yet to be seen. Insurance can instill confidence and reduce risks in carbon credit transactions. However, there are questions about the effectiveness of this market mechanism in terms of legal and documentation aspects and cost. The insurance market in this space is dynamic, with new policies emerging. Buyers need to consider what risks they are trying to mitigate and if insurance policies align with these needs. The insurance market in the context of climate change, and specifically carbon credits, is a developing solution, with ongoing evaluation of its suitability and effectiveness.

Despite current pricing and uncertainty in the market, are you optimistic about the state of the voluntary carbon market and why?

Overall, the panelists are optimistic about the future of the voluntary carbon market. This optimism is driven by the influx of new participants, emerging technologies, and a focus on co-benefits such as biodiversity. There is recognition that market participants are working collaboratively to address concerns, advance new technologies, and provide more transparency. The market’s dynamic nature, its innovation, and its entrepreneurial spirit compared to compliance cap and trade markets fuel this optimism. The commitment to continuous improvement and collaboration among all parties is seen as a positive sign for the market’s future.

Conclusion

Understanding the nuances of the VCM can be challenging, but with partners like CarbonBetter and Inlandsis by your side, it’s a journey you don’t have to undertake alone. Whether you’re just starting out, looking to improve your carbon accounting and reporting, or setting ambitious sustainability targets, we are here to assist you. CarbonBetter offers expert guidance, while Inlandsis provides access to innovative and impactful carbon reduction projects. Experienced partners can help you make informed, strategic decisions in your sustainability journey. Contact us to get started.

At CarbonBetter, we believe in progress over perfection. It’s not about doing everything—it’s about doing something. With over a decade of experience in the energy industry, we partner with organizations to guide them in the transition to a net-zero economy. CarbonBetter’s sustainability specialists work closely with partners across all industries to integrate sustainability solutions seamlessly into any business.

CarbonBetter helps organizations of all sizes measure, reduce, report, and offset their emissions, and tell stories about their sustainability journey.

Telling stories about sustainability efforts helps other organizations take action that will then, in turn, inspire others—it’s never too early or late to start.